Listen to This Article

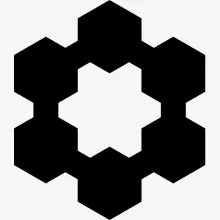

Tariffs are dominating the conversation, and for good reason. They’re a loud, unavoidable threat to supplier margins. But while you’re focused on this highly visible threat, another, quieter risk may be costing your business millions each year: the constant trickle of invalid deductions.

Shortages and compliance fees from retailers like Amazon and Walmart quietly chip away at your bottom line. These aren’t just the cost of doing business; they are errors that directly impact your profitability.

We recently brought together three retail recovery experts—Shelby Owens and Vanessa Cox from Carbon6, and Jessica Varon from SupplyPike—to create a practical guide for turning deduction recovery into a strategic margin driver.

You can watch the full webinar below, or read on for the 3-step revenue recovery playbook you can implement today.

The Full Picture: The Margin Risk Hiding in Plain Sight

Tariffs show up in forecasts and planning meetings. Deductions often don’t. They build quietly, piece by piece, across thousands of transactions.

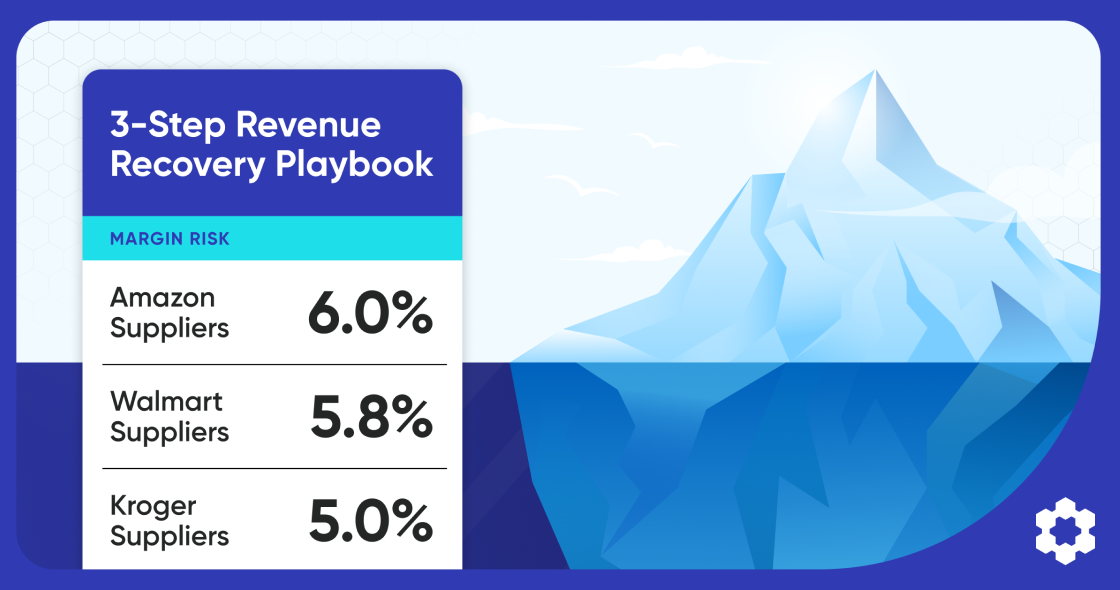

According to our experts, suppliers lose an average of 2-10% of their annual revenue to recoverable deductions. The breakdown by retailer is even more eye-opening:

- Amazon Suppliers: Lose ~6% of total revenue to deductions, a large portion of which are Amazon Shortage Claims.

- Walmart Suppliers: Lose ~5.8% of total revenue to deductions.

- Kroger Suppliers: Lose ~5% of total revenue to deductions.

As Vanessa Cox explained, these deductions create a “chain reaction.” A single missed scan at a receiving dock can trigger a shortage deduction, an on-time-in-full (OTIF) penalty, and a data compliance charge—all from one shipment. At Walmart, managing these issues means navigating programs like the Walmart SQEP and disputing through the Walmart APDP. When you multiply this across multiple marketplaces and thousands of orders, the losses become staggering.

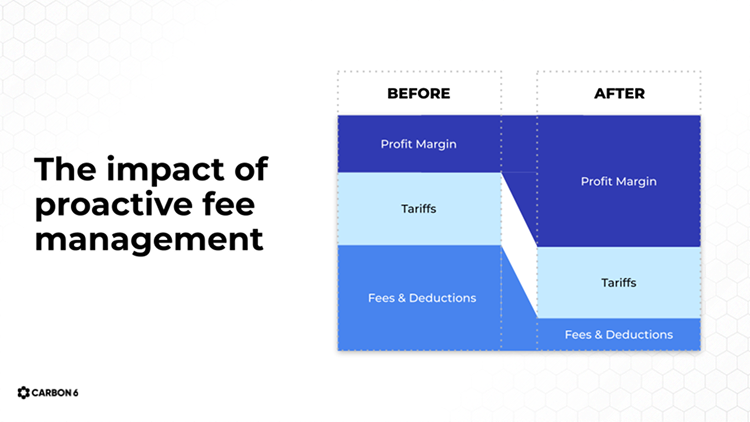

This was always a problem. But now, layer on new tariffs. As the chart below illustrates, what was once a healthy profit margin can quickly disappear.

The question then becomes: What can you control?

You can’t control global tariff policies. But you can control revenue leakage from invalid deductions. Here’s how top-performing suppliers are doing it.

The 3-Step Revenue Recovery Playbook

Step 1: Audit & Assess — Get a Clear View of the Damage

You can’t fix a problem you can’t see. The first step is to get a clear, data-backed picture of what’s happening in your business. Most suppliers are only scratching the surface of what’s recoverable because the data is siloed and overwhelming.

An audit provides a complete health report by answering critical questions:

- What are my top deduction types? Is it shortages, compliance fees, or accruals

- What is the total dollar impact? Quantify the size of the prize.

- Who owns this internally? Is it finance? Operations? Or is it falling through the cracks because ownership is unclear?

- What is our current dispute success rate? A Deduction Management ROI Calculator can help put this in perspective.

“This isn’t about pointing fingers. It’s about providing a clear, data-backed view of what’s being left on the table and where there’s room to improve.”

— Vanessa Cox, Carbon6

Step 2: Mitigate & Prevent — Get to the Root Cause

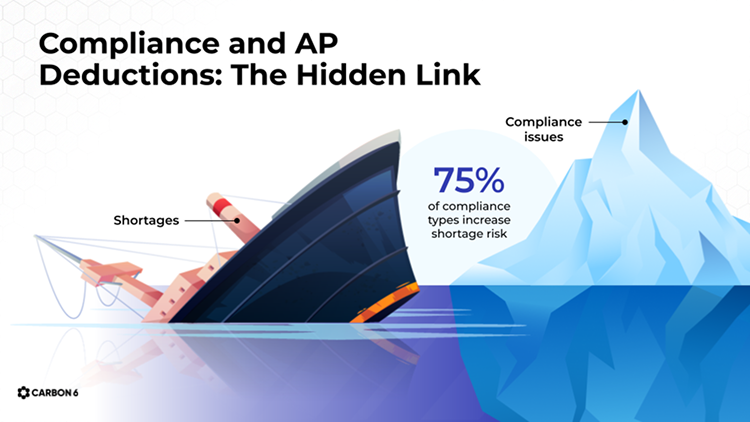

Once you know what’s happening, the next step is to understand why. The most effective suppliers move from a reactive “firefighting” mode to a proactive, preventative strategy by focusing on compliance. Our data shows that 75% of compliance issues directly increase the risk of an AP deduction.

Things like non-compliant packaging, incorrect labels, or ASN issues don’t just result in small fees—what Shelby Owens calls “death by a thousand cuts.” They create errors in the retailer’s receiving process, which directly leads to much larger shortage deductions.

To get ahead of this, our experts work with suppliers on root cause analysis, even participating in GEMBA Walks at Amazon fulfillment centers to observe the receiving process firsthand and identify where breakdowns occur. By fixing the small compliance issues, you prevent the large deductions from ever happening.

Step 3: Automate & Scale — Reclaim Revenue Without Adding Headcount

Let’s be honest: your team might not have time to manually track down proof of delivery for every single deduction across multiple retailer portals. The process is cumbersome, and many suppliers are forced to set internal thresholds (e.g., “we don’t dispute anything under $250”), leaving significant money on the table.

This is where automation becomes a game-changer. The goal is not just to dispute deductions more efficiently, but to build a scalable system. Leveraging software and automation allows you to:

- Gain Full Visibility: See all deductions from all retailers in a single dashboard.

- Automate the Process: Automatically gather the necessary documentation (POs, ASNs, shipping documents) and submit disputes in minutes, not hours.

- Reclaim Your Team’s Time: Free up your team from tedious administrative tasks so they can focus on high-value strategic work, like preparing for Amazon Vendor Negotiations using the insights from your deduction data. The Amazon AVN Checklist can be a valuable tool here.

“We went from managing this full-time with one analyst to just one to two hours a week. That time can be refocused on how to be more profitable.”

— Jessica Varon, SupplyPike

Your Questions, Answered

We wrapped the webinar with a live Q&A. Here are some of the top questions:

- What’s the most common mistake suppliers make when trying to recover deductions?

Answer (from Shelby): “Throwing everything at the retailer with a lack of proper documentation. The process is designed to be challenged, but it requires the right justification. Using the retailer’s own data to prove your case is key to maintaining a good relationship and a high success rate.” - How long does it typically take to start seeing results?

Answer (from Vanessa): “It can vary, but we typically start to see results in less than 30 days for some deduction types. The onboarding is quick, and the goal is to get you quick wins and ensure nothing falls outside the dispute window.” - Is it better to outsource this or build the capability in-house?

Answer (from Jessica): “Even with a dedicated in-house team, it’s nearly impossible to touch every deduction across multiple retailers. Automation is always going to be faster than humans. It gives you the scale to dispute everything and provides your team with the data and time to focus on prevention, which is where the long-term value lies.”

Take Control of Your Bottom Line

In an environment of rising tariffs and tightening budgets, focusing on what you can control is paramount. Deduction recovery is no longer just an accounting cleanup task—it’s a critical lever for protecting your margin and improving profitability.

By following this three-step playbook of Auditing, Mitigating, and Automating, you can turn a source of revenue loss into a strategic advantage.

Recover lost revenue from Walmart and Amazon—fast. Our expert-led deduction and chargeback management system helped Farouk Systems recover $1M in just 8 months. Explore Carbon6 Revenue Recovery.