Listen to This Article

Top Vendor and Seller News This Week

This week’s retail news centers on Amazon’s 2026 seller updates: FBA fee increases paired with new profit modeling tools, plus AI-driven automation for both third-party sellers and vendors.

- 2026 updates to US Referral and FBA fees: Amazon is introducing moderate FBA fee changes ($0.08 per unit on average) for 2026. It may seem small, but for sellers already juggling tight margins, every cent counts. The company also added new cost layers like region-based AWD storage, overmax handling, and inbound defect fees. Sellers will need to watch their operations closely and use profit tools to stay ahead of shrinking margins.

- Vendor Central tool updates: Amazon has released new tools to help vendors work smarter: an AI-powered Video Generator that creates customizable ad-ready videos in minutes, and a Potential Opportunity Analysis in the Concessions Hub that forecasts return-related losses and highlights high-impact ASINs for recovery.

As fee adjustments take effect, now’s the time to audit your cost structure, fine-tune inventory practices, and experiment with Amazon’s new AI capabilities to boost ad performance and profitability ahead of the busy holiday season.

Making Sense of 2026 Amazon FBA Fee Changes

For many Amazon sellers already navigating inflation, rising ad costs, and tighter consumer spending, Amazon’s 2026 FBA fee updates (effective January 15, 2026) may feel like another squeeze on profitability. While the average increase may look modest on paper, it’s the cumulative effect that stings. Between fulfillment fee hikes, new surcharges, and region-based AWD storage changes, sellers need to scrutinize their margins more closely than ever.

2026 Amazon FBA Fees Explained

Starting January 15, Amazon will revert to non-peak rates, but with adjustments across all price tiers and size categories. Here’s what’s changing:

Standard-size products ($10–$50)

Average fulfillment fee increase of $0.08 per unit.

- Small Standard: +$0.25

- Large Standard: +$0.05

Products priced under $10

Modest increase of $0.05 per unit, but they’ll continue to receive the Low-Price FBA discount, which is now $0.86 less than standard rates (up from $0.77).

Products priced above $50

Average increase of $0.31 per unit due to higher service requirements (e.g., faster processing, improved returns handling).

Weight-based pricing updates

For Large Standard, Small Bulky, Large Bulky, and Extra-Large units, Amazon will calculate fees using the greater of dimensional or unit weight, a change that may raise costs for lightweight but bulky items.

Here’s a quick example from Amazon’s 2026 fee table (excluding apparel):

| Size Tier | Price Range | 2025 Fee | 2026 Fee | Difference |

| Small Standard (≤4 oz) | $10–$50 | $3.15 | $3.42 | +$0.27 |

| Large Standard (1 lb) | $10–$50 | $4.99 | $5.04 | +$0.05 |

| Large Standard (2 lb) | $50 | $5.77 | $6.08 | +$0.31 |

For sellers moving thousands of units per month, those cents quickly add up, especially when layered with new fee categories and surcharges.

Additional Fees That Could Quietly Erode Margins

Beyond fulfillment, Amazon is introducing or adjusting several secondary fees that sellers should monitor closely.

Overmax Handling Fee

For Extra-Large products (up to 150 lb) exceeding 96 inches in length or 130 inches in length plus girth, new surcharges apply:

- 0–50 lb: +$17

- 50–70 lb: +$21

- 70–150 lb: +$25

Ships in Product Packaging (SIPP)

Products shipped in their original manufacturer packaging (without additional Amazon packaging) qualify for lower FBA fees, but non-certified bulky items could face added costs. Sellers should explore SIPP certification to offset fulfillment fee increases.

Low-Inventory-Level (LIL) Fee

Starting January 15, 2026, Amazon will calculate the LIL fee at the individual seller-FNSKU level (instead of parent-ASIN level), ensuring the fee only applies when your specific inventory falls below 28 days of supply based on both short-term (30-day) and long-term (90-day) historical demand.

The fee now extends to Small Bulky and Large Bulky products, while Grocery items and slower-moving products remain exempt, though low stock on exempt items may result in slower delivery promises or reduced availability. Fee rates range from $0.32 to $2.09 per unit, depending on size tier, shipping weight, and how severely inventory levels fall below the 28-day threshold.

Inbound Defect Fees

Shipments that don’t meet FBA requirements, such as misrouted or incomplete deliveries, may now trigger additional processing costs, as seen below.

Amazon Inbound Defect Fees: 2025 vs. 2026 Comparison

| Product Size Tier | Weight Range | 2025 Fee (Shipments created ≤ Jan 14, 2026) | 2026 Fee (Shipments created ≥ Jan 15, 2026) – Fee type unified under single rate for all defect types | Change ($) |

| Small Standard Max 15 × 12 × 0.75 in | ≤16 oz | Misrouted: $0.04 Deleted/Abandoned: $0.02 | $0.32 | +$0.28 to +$0.30 |

| Large Standard Max 18 × 14 × 8 in | ≤12 oz | Misrouted: $0.05 Deleted/Abandoned: $0.02 | $0.46 | +$0.41 to +$0.44 |

| 1.5+ – 3 lb | Misrouted: $0.06 Deleted/Abandoned: $0.03 | $0.59 | +$0.53 to +$0.56 | |

| 3+ – 5 lb | — | $0.74 | New tier | |

| 5+ – 7 lb | — | $0.94 | New tier | |

| 7+ – 10 lb | — | $1.14 | New tier | |

| 10+ – 15 lb | — | $1.44 | New tier | |

| 15+ – 20 lb | Misrouted: $0.07 Deleted/Abandoned: $0.04 | $1.74 | +$1.67 to +$1.70 | |

| Small Bulky Max 37 × 28 × 20 in | ≤5 lb – 50 lb | — | $1.38 – $5.25 | New tier |

| Large Bulky Max 59 × 33 × 33 in | ≤5 lb – 50 lb | — | $1.43 – $5.72 | New tier |

Amazon is consolidating fees, meaning sellers will now only pay a single inbound defect fee for all misrouted, deleted, or abandoned units (no separate inbound placement service fees). However, the fees will rise from just a few cents in 2025 (as low as $0.02–$0.07) to $0.32–$1.74 for standard-size products and up to $5.72 for bulky items in 2026.

The change suggests a stronger push for sellers to meet inbound compliance and shipment accuracy requirements, as even minor labeling or routing mistakes will now carry material financial penalties.

FBA Removal, Disposal, and Liquidation Fees

These will also rise in 2026, though orders placed before January 15 will still follow 2025 rates.

Returns Processing Fee

Products with high return rates will incur a new returns fee, varying by product size and weight. This change targets categories like electronics and home goods, where returns are more frequent.

What Sellers Are Saying: “The Slow Squeeze” Continues

Amazon’s 2026 FBA fee update didn’t exactly catch the seller community off guard, but it reignited familiar frustrations about rising costs and creeping complexity.

As Amazon veteran Jon Derkits wrote in a recent LinkedIn post, these updates reinforce what he calls his Three Immutable Laws of Amazon: every year, the platform becomes more expensive, more complex, and remains both the best and worst partner a seller can have.

That sentiment resonated widely among members of the seller community, who described the 2026 changes as another “slow squeeze” on their margins. “Nothing new here,” said one Amazon expert. Others urged sellers to fight back through packaging optimization, noting that small changes like angling or vacuum-shrinking products can cut FBA costs.

For many, the bigger frustration wasn’t just the increase itself but the growing complexity of Amazon’s fee structure. They pointed to the expanding list of charges, covering everything from excess and insufficient inventory to rising ad costs that now feel like an unavoidable part of doing business. Beneath the surface, some saw the 2026 changes as less about inflation and more about Amazon tightening control of its ecosystem, shifting volatility to sellers while securing greater stability for itself.

Save on FBA fees with the Product Resizer tool. Our free calculator shows how small packaging adjustments can move your products into lower-cost size tiers, saving thousands in fees. Calculate your savings now.

MCF, Buy with Prime, and AWD Fees Effective Jan. 15, 2026

Multi-Channel Fulfillment (MCF)

Amazon MCF fees will increase by $0.30 per unit on average, primarily affecting 1–2 unit orders. High-volume sellers can offset this with Preferred Pricing, offering up to 15% in discounts and $1 FBA credits per MCF unit.

Buy with Prime

Fulfillment fees increase by $0.24 per unit, though the Prime service fee minimum drops from $1.00 to $0.30, offering slight relief to smaller sellers.

Amazon Warehousing & Distribution (AWD)

The updated AWD rates are set to take effect on January 15, 2026.

- West region storage: Increases to $0.57 per cubic foot/month (from $0.48/cu ft previously, a 19% increase).

- AWD transportation fees: Base rate rises to $1.40 per cubic foot (from $1.15/cu ft in 2024), while Amazon managed is set to increase from $1.04/cu ft to $1.26/cu ft. So, AWD transportation fees will be about 20–22% higher starting January 2026.

- Both inbound and outbound box processing fees rise by $0.05 per box across all programs and regions.

- Discounts remain available (10% off Smart Storage and 20% off Managed Storage) but only for participating sellers.

If your AWD inventory is concentrated in the West Region, expect a noticeable cost bump in 2026. Sellers can reduce impact by rebalancing inventory to Other Regions where storage rates remain flat, and/or leveraging Smart Storage or Amazon Managed programs for 10–20% rate reductions.

How to See the Real Impact: Profit Analytics

Amazon is encouraging sellers to use Profit Analytics, a newly enhanced reporting tool that projects how fee changes will affect future margins.

Unlike older SKU reports, Profit Analytics integrates:

- Historical and future fee data side-by-side

- Granular SKU-level profitability insights (up to 500K listings)

- Integration of your own cost inputs (like COGS, inbound freight, or lead times)

Sellers can view:

- Total impact per product (absolute and percentage change)

- Unit economics breakdowns across all fees

- Net proceeds estimates, helping identify SKUs most vulnerable to fee erosion

In short, it’s not just about tracking fees; it’s about identifying where your profits are leaking before January 2026 hits.

Bottom Line

While Amazon’s 2026 FBA fee updates may look like “small” adjustments, they represent another incremental tightening of margins in an already competitive ecosystem. Sellers who rely on thin profits will feel the difference most, but those who leverage revenue calculators, optimize for SIPP, and plan inventory more strategically can still find room to thrive.

The next few months are critical: take this window before January to model your true costs, test new efficiencies, and recalibrate your pricing strategy because in 2026, every cent will count.

Amazon Releases AI Video Ad Generator and Predictive Return Analysis for Vendors

This week’s Amazon Vendor news includes the retailer equipping vendors with two new tools designed to boost marketing efficiency and financial visibility.

Create Sponsored Ad Videos in Minutes

Amazon’s new AI-powered Video Generator allows vendors with Sponsored Ads accounts to produce professional, ad-ready videos at no extra cost. The tool automatically pulls content from your product detail page and assembles a short promotional video in minutes — complete with customizable text, fonts, calls-to-action, and logo options.

This means vendors no longer need expensive video production resources to compete in an ad environment increasingly dominated by video content.

For example, a brand can generate a lifestyle clip showcasing a new product line for a Sponsored Brands campaign, edit it directly within Vendor Central, and launch it the same day—all without hiring a production team.

Predict and Prevent Return-Driven Losses

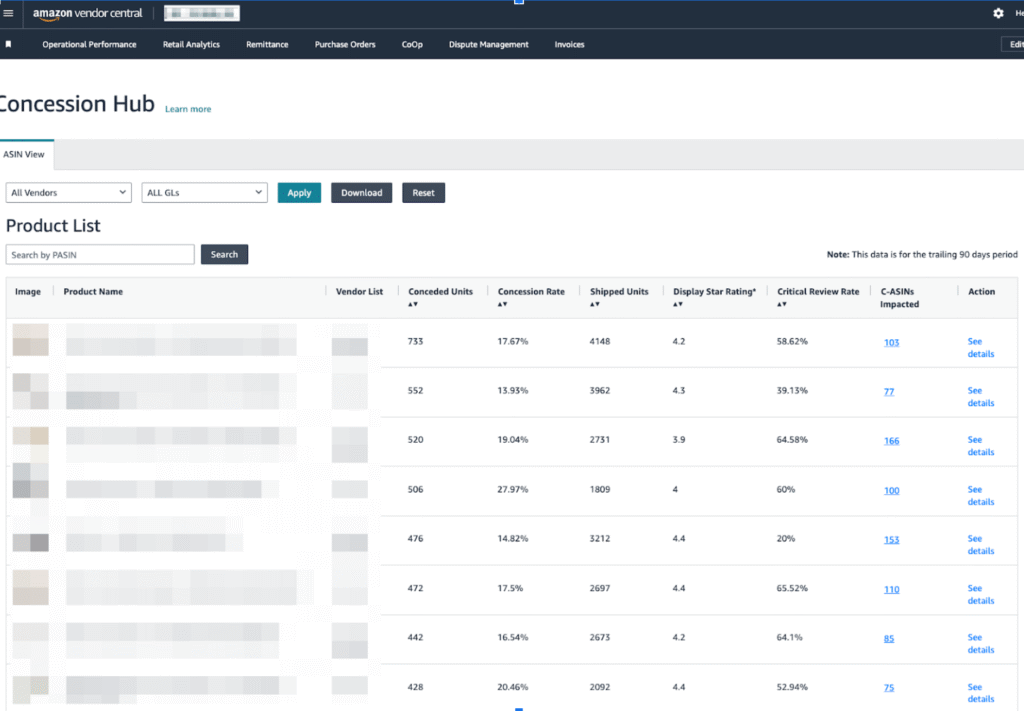

In the Concessions Hub, Amazon has introduced a potential opportunity analysis tool to help vendors estimate the financial impact of defect-driven returns over the next 30 days.

As shown in the updated dashboard, vendors can now see metrics such as conceded units, concession rate, shipped units, and critical review rate, which are all tied to specific ASINs.

With this tool, vendors can assess how returns affect ROI, identify high-priority ASINs with recurring quality or fulfillment issues, and turn potential losses into proactive improvement plans. For example, a vendor noticing a high concession rate for one SKU can dig into the data, identify a packaging defect, and prevent hundreds of future returns before they occur.

Other Retail News This Week

1. Streamlined Listing Management on the New “Manage All Inventory” Page

Amazon has redesigned the Manage All Inventory page to make listing management faster and more intuitive, especially for large catalogs. Sellers can now complete drafts in one place, quickly reactivate suppressed listings with new Quick Filters, and optimize multiple listings in bulk with automated improvement suggestions.

2. Submit Your Black Friday & Cyber Monday Deals by October 28

Amazon’s biggest sales events are fast approaching, and you have until October 28 to submit your deals and discounts. Whether it’s Best Deals (15%+ off, $1,000 fee), Lightning Deals (20%+ off, $500 fee), Prime Exclusive Discounts (15%+ off with event badging for $245), or Coupons ($5 flat fee + 2.5% of sales), now’s the time to plan your pricing strategy.

3. Add Customization Options to Your Listings for the Holiday Rush

Personalized gifts are trending this season, and Amazon Custom now makes it easier to offer them with new bulk upload tools. Let shoppers add text, images, or configurations, and use the “option chooser” template to streamline setup. Visit Amazon Custom to enable personalization before the holidays and join the live Q&A on October 23 for expert tips.

Small Tweaks, Big Impact on Amazon Seller Margins

Retail news takeaway: Amazon FBA’s 2026 fee updates may read like small tweaks, but together they mark another turning point in how profitability is managed on the platform. To stay competitive, act now—before the new rates take effect in January. Here’s your rapid-fire checklist:

- Run a profit analysis to spot at-risk SKUs and reprice before the January 15 fee hike.

- Optimize packaging, certify for SIPP, and tighten inbound accuracy to prevent new fees.

- If using AWD, consider moving stock from the West Region (be sure to calculate the cost difference between keeping stock in the West versus other locations) and use Smart or Managed Storage to save up to 20%.

- Compare FBA vs FBM costs to offset hikes and avoid bulky surcharges.

- Stress-test 2026 pricing and inventory plans in Q4 to stay ahead of the “slow squeeze.”