Listen to This Article

Top Retail News to Know This Week

This week’s retail news brings a flood of holiday-driven innovation as Walmart, Amazon, Google, and Pinterest race to remove friction from shopping at the exact moment consumers are making their final gift decisions.

- Holiday delivery & checkout updates from Walmart and Amazon: Walmart and Amazon extend their holiday shipping deadlines, and Amazon introduces one-tap “Add to Delivery” for faster impulse purchasing.

- Google tests social channel insights in search console: Google pilots a feature that showing performance of linked social profiles, offering a unified view of website and social visibility.

- Major platforms deepen strategic partnerships across commerce & logistics: Pinterest collaborates with Walmart on shoppable recipes while Amazon advances grocery delivery, AI, and a $35B India investment in logistics, while USPS negotiations stall.

Let’s dive into the stories driving holiday performance and long-term platform strategy.

One-Tap Orders and One-Hour Delivery: Inside This Year’s Holiday Shopping Speed Push

If there’s one theme dominating holiday retail news this year, it’s speed. Walmart and Amazon are pulling out all the stops to ensure customers get their last-minute gifts on time while keeping sellers competitive in the year’s most intense shopping days.

Walmart Leans Into Last-Minute Delivery Like Never Before

Walmart is going all-in on holiday speed this year, offering one-hour Walmart Express Delivery on orders placed up to 5pm on Christmas Eve. From forgotten toys to missing dinner ingredients, Walmart is positioning itself as the go-to destination for shoppers who push holiday prep right to the wire.

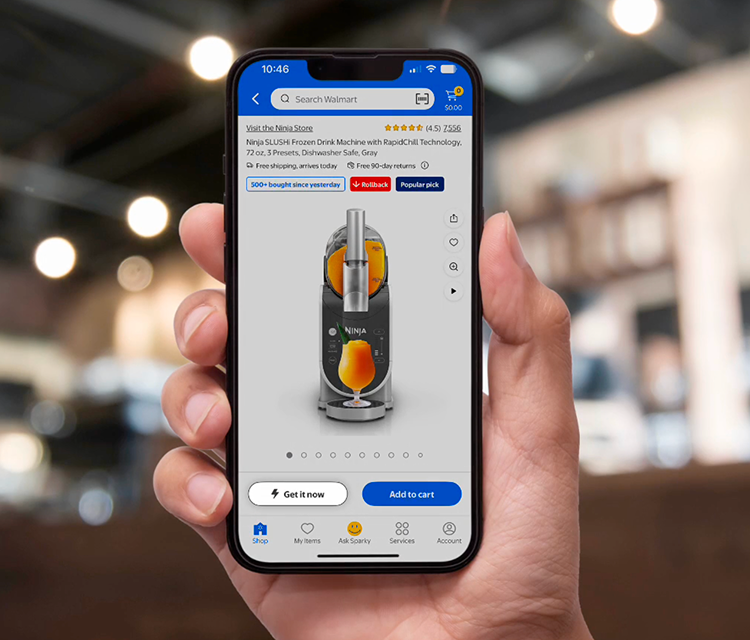

The retailer also introduced a new “Get it Now” feature in the Walmart app, showing customers how many minutes until their order arrives paired with one-tap ordering to reduce hesitation and speed up decision-making. With delivery now reaching 95% of US households in under three hours, Walmart is making convenience its core holiday promise.

Amazon Reinvents Checkout With One-Tap “Add to Delivery”

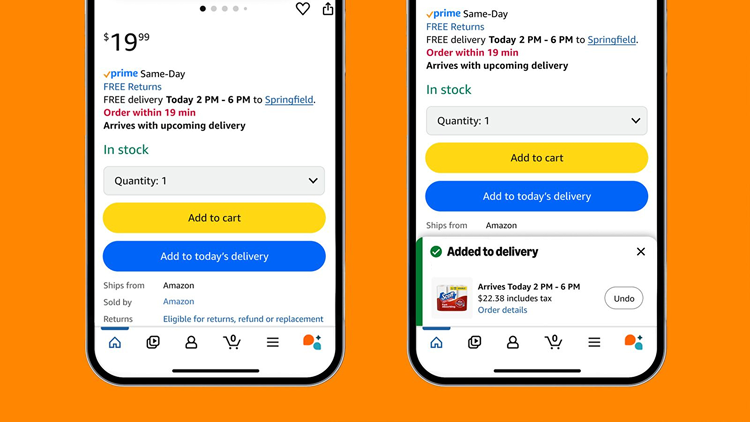

Amazon’s biggest holiday innovation this year isn’t faster trucks, it’s a redesigned checkout experience. The new Amazon Add to Delivery feature lets Prime members instantly add items to an upcoming shipment without going through the cart or checkout again. Tap once, and the item is added and charged immediately.

Extended Prime Shipping Cutoffs Give Sellers More Time

To support the surge in late-season shopping, Amazon has extended both FBA and Seller Fulfilled Prime cutoff dates to December 23, 2025, giving sellers two more selling days than last year.

Key opportunities for sellers include:

- Super Saturday (December 20), which is a high-traffic shopping day with guaranteed Christmas Eve delivery.

- Coupons and price discounts, which benefit from Amazon’s promotional support.

- Sponsored Products and Sponsored Brands ads that are crucial for capturing last-minute search visibility.

- Enhanced A+ Content to convert fast-scrolling, time-crunched shoppers.

Last-minute buyers are still searching heavily through December 23, making this one of the most profitable windows of the season.

The Hidden Downsides of Frictionless Holiday Shopping

While Walmart’s Get It Now and Amazon’s Add to Delivery both push the boundaries of speed and convenience, they also raise new questions about the unintended consequences of ultra-frictionless shopping, especially during the high-pressure holiday period.

One-click ordering removes the usual “pause points” that give shoppers time to reflect, compare, or reconsider. The blue Amazon Add to Delivery button is a prime example: it replaces the familiar yellow “Buy Now” button with softer, lower-stakes language. The color change and phrasing indicate something closer to “toss this in your order” rather than “make a purchase,” which subtly reduces the psychological weight of spending. With one tap, the item is not only added to the next shipment but also charged instantly, meaning no cart review, no checkout page, no moment to rethink.

Walmart’s Get It Now feature introduces a similar behavioral change. One-tap ordering combined with real-time countdowns (“Arrives in X minutes”) creates a heightened sense of urgency that may encourage shoppers to act first and reflect later. Speed becomes the selling point, and hesitation becomes the enemy the feature is designed to eliminate.

But what happens when hesitation disappears entirely?

- Will we see more shoppers accidentally tapping Add to Delivery during the holiday rush?

- Could this lead to a spike in cancellation requests or an uptick in returns marked “bought by mistake”?

- Is Amazon tracking these behaviors internally, and if so, will sellers ever see those metrics? (Right now, it’s doubtful.)

For sellers, these questions matter. While streamlined ordering boosts conversion, it also increases the risk of returns, order cancellations, and inconsistent demand patterns. The psychological design changes that make buying easier also make regretting purchases easier.

As frictionless features gain traction, sellers should monitor return reasons, watch for unusual post-purchase behavior, and plan for potential spikes in “mistaken” orders. Convenience drives sales, but it can also drive refunds if not carefully managed.

Google’s New Social Channel Insights: What It Means for SEO, Social Reach, and Off-Amazon Advertising

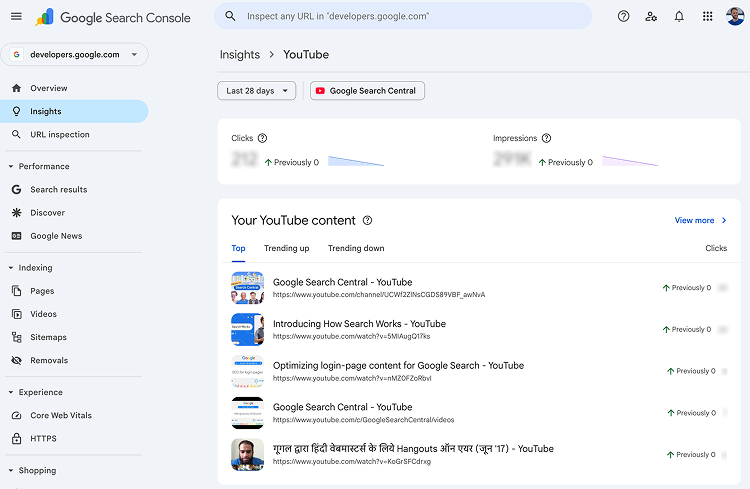

Google just connected two worlds brands have long managed separately: website SEO and social media visibility. With its new Social Channel Insights experiment in Search Console, brands can now see how their YouTube, Instagram, TikTok, or other eligible social profiles perform directly in Google Search, offering a unified view of discoverability across platforms.

This update matters for every Amazon seller investing in off-Amazon traffic, social content, brand-building, and SEO. Here’s what’s changing, why it’s happening, and what sellers should do next.

Google Brings Social Performance into Search Console

Google announced a major update that pulls social channel data directly into the Search Console Insights dashboard. For the first time, site owners can see how searchers discover their social profiles, just as they would track website pages.

Key Features

- Total reach: clicks and impressions sending users from Google Search to your social channels.

- Content performance: top-performing posts and which ones are trending.

- Search queries: the keywords leading users to your social profiles.

- Audience location: top countries where users click into your channels.

- Additional sources: traffic coming from Image Search, Video Search, News, and Discover.

This rollout is still experimental and available only to a limited number of sites Google has automatically identified. If you’re part of the test, Search Console will prompt you to add the connected channels.

Why Google Is Doing This Now

Consumer behavior has changed drastically:

- Two-thirds of American consumers now use social platforms as search engines.

- 40% of Gen Z prefers TikTok or Instagram over Google for topics like fashion, food, or gift ideas.

- Global social media usage has hit 63.9% of the population, with users spending more than 2 hours per day on platforms.

With social discovery rising and brand authority increasingly shaped by social presence, Google is adapting by treating social platforms as integral parts of a brand’s searchable identity.

This experiment suggests Google’s acknowledgment that SEO and social content are now inseparable.

What This Means for Sellers and Brands

This unified reporting gives digital marketers something they’ve never had before: a top-down view of how people discover their brand across both owned and social channels. For example, you can see which social posts rank in Google Search and drive discoverability or understand which queries users search before landing on your social profiles.

For Amazon sellers, this is especially powerful. Off-Amazon traffic (whether from Facebook, YouTube, TikTok, or articles) can influence brand visibility, external traffic, and even ranking momentum. Now, some of that influence becomes measurable.

How This Connects to Off-Amazon Advertising

This update strengthens the link between content marketing and SEO. For example:

- A viral TikTok that shows up in Google Search can become an ongoing funnel of discovery and external traffic.

- YouTube videos that rank for product-related keywords can strengthen brand relevance signals.

- Media write ups that appear in Google results can boost brand authority, which Google increasingly considers.

- Sellers running off-Amazon ads can now see how their social channels perform in Search without relying solely on platform-native analytics.

For brands investing in influencers, shoppable videos, blogs, or external ads (Meta, TikTok, Google Ads), this single dashboard gives better visibility into what’s working across ecosystems.

Drive high-converting external traffic to your Amazon listings with PixelMe, our AI-powered external traffic solution. Boost your organic rank, maximize ROAS, and unlock Amazon’s Brand Referral Bonus program with ease. Get your free ASIN audit now.

Looking Ahead

Google is actively requesting feedback, and because this is early-stage, the features could evolve quickly. For now:

- You cannot manually add social channels.

- Only channels Google has auto-detected will appear.

- More platforms and analytics are expected if users find value in the experiment.

This move strongly hints that Google sees social signals (and overall digital footprint) as integral to search relevance.

Major Platforms Form Strategic Partnerships to Control End-to-End Commerce

The world’s biggest platforms are strengthening their ties across commerce, logistics, and global infrastructure. From Pinterest and Walmart syncing recipe inspiration with cart-building to Amazon expanding grocery delivery, reevaluating the USPS relationship, and injecting billions into India’s digital and logistics ecosystems, these initiatives point to one trend: platforms are building interconnected retail networks designed to optimize every step of the shopping journey.

Pinterest x Walmart: Turning Inspiration Into Instant Commerce

Pinterest is pushing toward its vision of making “every Pin shoppable,” and its newest partnership with Walmart is the clearest step yet.

- Users can now tap “Shop Ingredients” on eligible Pinterest recipe Pins and instantly add items (complete with swaps and real-time pricing) to their Walmart cart.

- Customers can choose their preferred store and opt for pickup or delivery, seamlessly bridging discovery and checkout.

- With 600M monthly active users, Pinterest’s growing shoppable tools (holiday gift guides, beauty analysis tools, and where-to-buy ads) create powerful off-Amazon customer acquisition lanes.

Brands benefit from inspiration-driven conversions, and consumer packaged goods sellers on Walmart Marketplace can now catch Pinterest-driven demand spikes more reliably than ever.

Amazon Expands Same-Day Grocery Delivery to 2,300+ US Cities

To step up competition with Walmart, Amazon is aggressively scaling its Same-Day delivery network now reaching more than 2,300 cities and towns, with fresh groceries accounting for nine of its top ten items ordered.

- Perishable grocery sales grew 30x since January, showing strong adoption.

- Customers who add fresh groceries to Same-Day orders shop twice as often.

- Amazon added over 30% more grocery SKUs and doubled down on its own private-label line, Amazon Grocery.

- Prime members now enjoy free Same-Day Delivery on orders over $25 in most areas.

Amazon is creating a one-cart world, one where groceries, electronics, gifts, and essentials arrive together, and sellers gain from increased purchase frequency.

Amazon USPS Partnership Reassessed Amid Network Expansion

While Amazon invests in faster delivery, its talks with the US Postal Service (USPS) have hit a wall, prompting the company to reevaluate its reliance on the carrier.

- Amazon currently accounts for $6B of USPS revenue, or 7.5% of its annual income.

- USPS is planning an auction for facility access, forcing Amazon to compete with other retailers and carriers.

- Amazon is exploring alternatives, including expanding its own delivery fleet, while negotiating to avoid pulling billions of parcels from USPS.

Any major shift in Amazon’s carrier strategy could affect shipping times, costs, and fulfillment routing for sellers. Amazon’s growing independence could mean stricter control, but also changing delivery dynamics.

Amazon Commits $35B to India: AI, Infrastructure & Export Growth

At the Amazon Smbhav Summit, the company revealed a massive $35B investment through 2030, focused on AI, logistics, and job creation.

Key impact highlights:

- Digitized 12M+ small businesses and enabled $20B in cumulative exports so far.

- Plans to boost exports to $80B by 2030.

- Will support 3.8M jobs across technology, logistics, packaging, manufacturing, and more.

- Expanding AI tools like Seller Assistant, Next Gen Selling, and multilingual shopping experiences.

India is becoming one of Amazon’s most important markets and a massive sourcing hub. Sellers leveraging Indian suppliers, logistics, or expansion into Amazon India stand to benefit from improved infrastructure and streamlined export pathways.

Across these updates, a clear pattern emerges: platforms are partnering to expand reach and capabilities. Discovery sites are becoming marketplaces, fast delivery is reshaping grocery shopping, and global markets like India are hubs of innovation. Retail is evolving, creating an environment where integration beats isolation and speed feeds scale.

Other Amazon Sellers News This Week

1. Passkey Verification for Seller Central (Dec 2, 2025)

Amazon is introducing Passkey verification, a password-free sign-in method using your device’s fingerprint, face scan, or PIN. This provides stronger security than two-step verification, with end-to-end encryption and seamless access across devices. Set it up now to protect your account and enjoy faster logins.

2. FBA Prep Service Ending (Jan 1, 2026)

Amazon will no longer offer prep and labeling services for US FBA shipments, including inventory sent via AWD, AGL, Amazon SEND, or Supply Chain Portal. Sellers will need to handle prep internally or through third-party partners to ensure compliance and avoid delays.

3. Commingling Practices Ending (Mar 31, 2026)

Amazon is ending commingling, so orders will ship solely from your inventory and won’t use other sellers’ stock. Brand Representatives can use manufacturer barcodes without Amazon stickers, while non-Brand Representatives must continue using Amazon stickers for all products. Products without manufacturer barcodes still require stickers. Review the latest guidance on barcode choices and labeling to stay prepared.

Accelerate Growth Through Speed and Strategic Partnerships

Speed and strategic partnerships dominate retail news this week, shaping not only how consumers shop but also how sellers need to operate. From one-tap ordering to same-day groceries and Pinterest-driven cart conversions, sellers can act quickly to capitalize on these trends:

- Optimize for frictionless shopping: Ensure listings, inventory, and images are ready for one-tap purchases on Walmart’s Get It Now or Amazon’s Add to Delivery.

- Leverage last-minute demand: Plan promotions around extended Prime cutoffs and high-traffic days, using coupons, Sponsored Products, and A+ Content.

- Monitor returns: Track “ordered by mistake” returns and cancellations to spot patterns and adjust strategy.

- Bridge channels: Use Google’s Social Channel insights to identify which posts or campaigns drive traffic and optimize cross-platform content.

- Explore partnerships: Align with marketplaces and global initiatives like Amazon India to gain exposure, faster logistics, and new markets.

For nearly five years, we’ve kept sellers informed, publishing 250 issues packed with policy changes, announcements, and community events. Subscribe below or share with your team to get these insights delivered weekly.