Listen to This Article

Top Amazon FBA News This Week

This week, Amazon sellers have been thrust into the spotlight as the platform grapples with the real-world impact of the intensifying US-China trade war.

- Amazon seeks seller feedback on tariffs PLUS Buy Box fallout: Amazon is surveying sellers to understand how new US tariffs—especially on Chinese imports—are impacting pricing, sourcing, and logistics. Vanessa Hung confirmed the detailed emails, which reflect Amazon’s push to gather real-time insights. As costs rise, some sellers are also calling for Buy Box and fee policy changes, arguing that tariff-driven price hikes are hurting their visibility and sales.

- Canada Prime Day and Pet Day prep in full swing: Key deadlines for Canada Prime Day 2025 are approaching, with deal submissions open and final cutoffs in May and June—vendors must include reference prices and check for promotional fees. Amazon Pet Day also returns May 13–14, offering two days of pet-focused deals and a strong sales opportunity for pet category sellers.

Keep reading for a full breakdown of each update and what it means for your business.

Beyond Price Hikes: The Tariff Fallout Rocking The Seller Community

The ripple effects of President Trump’s newly escalated tariffs on Chinese imports are being felt across Amazon’s marketplace—and for many third-party (3P) sellers, the consequences could be business-defining.

With tariff rates on some goods from China spiking to as much as 245% as of April 15th (not a typo), sellers are navigating a maze of uncertainty. From sourcing strategy changes to intense pricing pressures, the weeks following “Liberation Day” have brought a new wave of challenges that may reshape how—and from where—Amazon products are sourced.

Let’s break down how sellers are adapting, what Amazon is doing behind the scenes, and what you can do right now to weather the storm.

Amazon Profitability Webinar Replay Now Available

Concerned about rising Amazon promotional fees and unpredictable tariff changes affecting your bottom line? Our recent “Hustling Margins” webinar covered strategies to protect your profitability. Sellers even requested a Part 2 due to the current challenges! Watch the replay to access free tools, including the Promo Fee Calculator and Tariff Impact Calculator, plus practical cash flow and fee reduction tactics.

Who Pays Tariff Costs?

Amazon CEO Andy Jassy acknowledged the tough reality: sellers will likely have to pass increased costs on to customers. During a CNBC interview, Jassy emphasized that while Amazon would do its best to keep prices low, the marketplace’s structure means sellers will ultimately bear the burden—and likely shift it to consumers.

- Tariffs surged to 145%+ on many Chinese-made goods.

- Amazon sources a significant share of its marketplace inventory from China—Wedbush Securities estimates up to 70%.

- While tariffs on some countries were paused, those in China remain elevated.

One seller, Ramon Gonzalez, who runs a family card game business on Amazon, exemplifies the real-world impact. Facing a 145% tariff on an incoming $10,000 shipment, Gonzalez now contemplates whether to increase the price of his $24.97 card set to nearly $40—a move that could crush sales.

Amazon’s Multi-Pronged Response: Asking Sellers, Recommending Europe

Amazon isn’t sitting still. In addition to CEO-level reassurances, the company is actively reaching out to sellers for feedback on how tariffs are impacting their businesses.

- Emails from Amazon’s strategic and global account managers are prompting sellers to share changes in sourcing strategies, pricing models, and logistics costs.

- Some sellers received pitches to expand to Amazon’s European marketplaces, with launch incentives and fee credits to reduce barriers.

This outreach signals more than concern—it’s a data-gathering mission. As Vanessa Hung pointed out, Amazon is likely collecting field intel to adjust category pricing tools, recalibrate its marketplace policies, or update seller fee structures.

Pricing Power and the Buy Box: A Complicated Catch-22

Sellers trying to raise prices to absorb tariffs are facing another hurdle: Amazon’s Buy Box algorithm.

- To “win” the Buy Box (the default “Add to Cart” option), sellers often need to offer the lowest available price—not just on Amazon, but across all sales channels.

- Sellers raising prices on Amazon (due to tariffs) risk losing the Buy Box to competitors who haven’t adjusted pricing yet, or worse—have to stop selling entirely.

Brandon Fishman, CEO of VitaCup, started a petition urging Amazon to give brands more control over their pricing.

“Businesses need to react quickly to the tariffs, which have been changing daily, and right now they can’t pivot fast enough due to the buy box suppressions from price increases,” said Dave Cassarino, Director of Amazon Marketing at National Positions.

Without the Buy Box, even a great product becomes virtually invisible to shoppers.Some sellers are choosing not to send new shipments at all, preferring to wait out the chaos rather than sell at a loss.

Final Thoughts

This is a moment of reckoning for many Amazon sellers. The combination of rising Trump tariffs, pricing constraints, and changing marketplace rules makes for a volatile environment. But as always in ecommerce, those who adapt fastest stand the best chance of survival. Stay informed, stay flexible, and don’t be afraid to rethink your strategy—even if it means going global, retooling your products, or speaking up to Amazon directly.

Canada Vendor Prime Day Deals and Amazon Pet Day

As Amazon gears up for two major events—Canada Vendor Prime Day and Amazon Pet Day—brands are facing both opportunities and challenges that could shape their Q2 strategies.

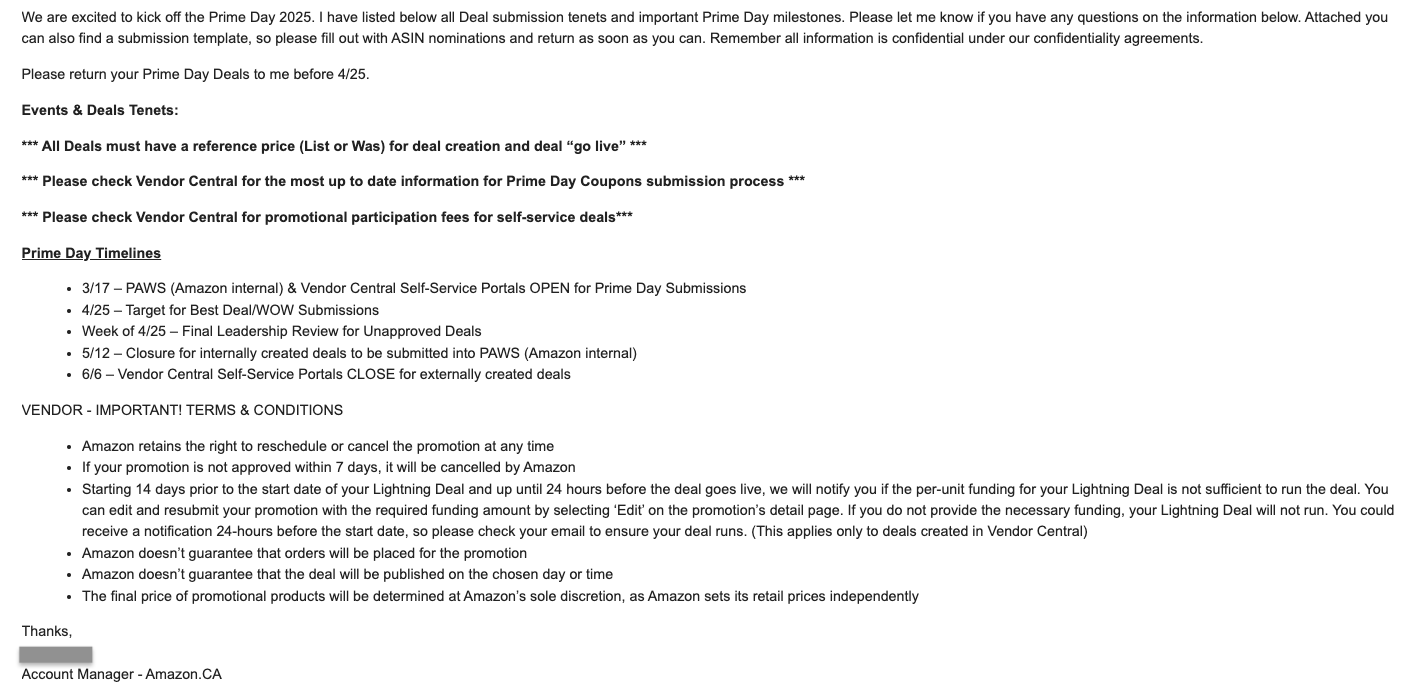

Canada Vendor Prime Day 2025 Deals Guideline

Canada Vendor Prime Day is a sales event available only to 1P Vendor brands on Amazon. According to internal documentation shared with the Carbon6 team, 1P vendors must comply with a series of conditions to ensure their promotions are even considered.

- All deals must have a reference price (“List” or “Was”) to qualify for creation and submission.

- Submission windows are tight:

- March 17: Programming Amazon Web Services (PAWS, Amazon internal) & Vendor Central Self-Service portals open for deal submissions.

- April 25: Deadline for Best Deal/WOW submissions.

- May 5: Closure for internally created deals to be submitted into PAWS.

- June 6: Final closure of Vendor Central for external deal creation.

- Deal approvals are not guaranteed: If a deal isn’t approved within 7 days, it will be canceled automatically.

- Lightning Deal funding warnings can come as late as 24 hours before the deal goes live, putting pressure on brands to monitor emails and quickly edit promotions or risk disqualification.

- Amazon retains pricing control and may reschedule or cancel a deal without notice.

Meanwhile in the US: Amazon Pet Day Promises a Sales Surge

While Canada Prime Day prep ramps up north of the border, Amazon Pet Day returns to the US on May 13–14, offering a more accessible and targeted event. Early deals start April 29. Unlike Prime Day, Pet Day doesn’t require sellers to jump through as many hoops—and it’s open to all Amazon customers, not just Prime members.

Plus, Amazon is leveraging generative AI tools like Rufus and personalized Pet Profiles to improve customer discovery and recommendation, giving well-positioned listings a chance to shine.

Key features that can boost visibility include:

- Gift Lists for pet milestones like “gotcha” days or birthdays.

- Shopping Guides to simplify decision-making.

- Subscribe & Save incentives for recurring purchases.

Amazon Pet Day might not be Prime Day in scale, but for pet brands, it’s a golden opportunity with lower friction and solid conversion potential.

With both events offering unique benefits and logistical hurdles, now is the time for brands to get proactive. Whether you’re pushing deals for Prime Day in Canada or riding the tail-wagging momentum of Pet Day in the US, strategic preparation is key to staying ahead in Amazon’s fast-moving marketplace.

Other Amazon Seller Updates This Week

1. UK Multi-Channel Fulfilment Fee Changes Coming May 15

New fee structures will include lower envelope rates and reduced pricing for small parcels, along with a consolidated oversize pricing model. These changes are meant to simplify the system while slightly increasing fees for larger items.

Navigate Amazon’s complex fee structure with our latest Fee Stack white paper. Our third edition provides a complete breakdown of 2025 fee updates and actionable strategies to help you protect your margins. Get your free guide now.

2. Identify Global Sales Opportunities with Marketplace Product Guidance

Sellers in the UK and Germany can now use the “Global demand for your products” feature in Marketplace Product Guidance to find international sales opportunities. Get a personalized list of high-demand products from your catalog, plus insights like sales forecasts and category trends in top global markets. Access it via Growth > Marketplace Product Guidance > Global demand for your products.

3. Veteran Sellers Continue To Dominate The Marketplace

Marketplace Pulse reports that more than 60% of the top 10,000 sellers on Amazon.com joined before 2019, showing that long-term experience is a major advantage. While new sellers continue to join, only a small percentage remain active or reach top ranks.

4. Amazon Ramps Up AI To Fight Counterfeits

Amazon seized over 15 million counterfeit products in 2024—more than double the previous year—using advanced AI to scan listings, images, and seller behavior. The company is also working with law enforcement globally to dismantle major counterfeit networks.

Unlock the future of ecommerce with our AI Revolution white paper. Discover how leading Amazon sellers leverage AI for personalization, product research, and advertising optimization. Download your free guide now and start integrating AI.

5. Clarification On Amazon Vine Review Policies

Amazon clarified that Vine reviews are aggregated at the parent ASIN level, not by variation, and outlined how many reviews can be retained per enrollment tier. Sellers are voicing concerns about review manipulation and the authenticity of some Vine feedback.

6. Amazon Ads Offers Incentives To Win Over Media Buyers

Amazon is offering financial perks and lower tech fees to attract advertisers to its DSP, including bonus media spend and reduced platform costs. The goal is to compete more aggressively with ad giants like Google and The Trade Desk.

Expand your reach with DSP Prime. Our expert-managed advertising solution leverages Amazon’s first-party data to connect your brand with high-intent audiences across websites, apps, and streaming platforms. Get your customized growth plan now and launch in just 10 days

Tactical Responses to Tariffs and Prime Day Preparation

With tariff pressures rising and key sales events on the horizon, you need to strike a balance between protecting margins and seizing new opportunities. Here are a few focused strategies to help you stay competitive and adapt effectively.

- Reevaluate Pricing and Sourcing Strategies: Use C6’s Amazon tariff calculator to assess cost impact. Explore alternative suppliers outside China and adjust margins before submitting Prime Day deals.

- Expand Globally to Offset Domestic Pressure: Consider expanding into European marketplaces, where consumer demand is rising and tariffs may be less punishing.

- Limit Shipments, Watch the Market: Like Gonzalez, you may want to reduce order volume temporarily and delay large shipments until the tariff landscape stabilizes.

- Be Proactive with Promotions: To prepare for Canada Vendor Prime Day, include a reference price with each deal and check Vendor Central for updated fees and funding rules to avoid cancellations. For Amazon Pet Day, optimize listings for pet profiles, gift lists, and AI tools like Rufus. Early deals start April 29.

- Monitor and Adjust for Buy Box Challenges: If you’re increasing prices due to tariffs, keep a close watch on your Buy Box eligibility using real-time monitoring tools.

- Engage with Amazon’s Outreach: If Amazon contacts you for feedback, respond. Your insights may influence future marketplace changes—and ensure your challenges are heard at the top.

For nearly four years, we’ve kept sellers informed with our Amazon Sellers Newsletter, publishing over 200 issues packed with policy changes, announcements, and community events. Subscribe or share with your team to get these insights delivered weekly.