Listen to This Article

Top Amazon Sellers News to Know This Week

This week’s Amazon seller updates roundup kicks off with a powerful consumer trend that’s reshaping search behavior on the platform.

- Surge in “Made in USA” Searches on Amazon: Consumer searches for American-made products are up 220% year-over-year—though it hasn’t yet led to widespread purchases– it could present branding opportunities for domestic sellers.

- Walmart Launches “Grow With Us” to Support US Suppliers: In response to potential new tariffs, Walmart launched the “Grow With Us” program to help small US businesses become suppliers and strengthen domestic supply chains.

- Seller Fulfilled Prime (SFP) and Premium Shipping Policy Updates: Amazon is updating its SFP and Premium Shipping programs with stricter limits, tighter rules, and a new appeal process.

From shifting shopper priorities to tightened program standards, this week’s Amazon updates reveal where the market is headed—and how sellers can stay one step ahead.

Walmart Bets Big on American-Made as Amazon Sellers Test Patriotic Messaging

Tariffs are rattling retail and ecommerce, driving new interest in American-made products. Amazon and Walmart sellers are responding with “Made in USA” messaging and domestic business initiatives. Here’s how these forces affect sellers.

Rising Interest in “Made in USA” Products on Amazon

Recent data from SmartScout reveals a sharp rise in Amazon searches for US-made goods:

- Searches for “made in USA products only” are up 220% year-over-year.

- “American flag made in America” saw a 250% increase in search volume.

- Agencies like Avenue7Media report a 5x increase in search interest for these keywords compared to the same month last year.

Despite this surge in curiosity, it hasn’t yet led to a wave of new sales. According to Jason Boyce of Avenue7Media, this interest “it’s not driving a lot of revenue growth”—not yet, anyway. SmartScout founder Scott Needham echoed this, noting many customers are browsing, but not necessarily buying.

Still, sellers are paying attention. They’re experimenting with new creative strategies:

- Featuring patriotic imagery like flags or “Made in America” stamps in primary product images.

- Testing “Made in USA” SEO keywords in titles and bullet points.

- Leaning into messaging like “Not Made in China” to signal value alignment with shoppers wary of rising import costs.

Yet the core challenge remains: Amazon customers are still largely price-driven. Amazon’s low-price reputation—14% cheaper than competitors on average—has traditionally made country-of-origin a lower concern.

For sellers willing to adjust their positioning, messaging, and partnerships, this may be the moment to turn patriotic curiosity into real conversions.

Walmart’s Grow With Us Program Backs US Suppliers

While Amazon is passively riding the wave of patriotic search trends, Walmart is taking a proactive approach.

In response to mounting tariff pressures, Walmart recently launched the “Grow With Us” initiative—a four-step program aimed at helping US-based small businesses succeed on its platform and in stores.

- Learn: Small brands can access 30 free e-learning modules via Walmart’s Supplier Academy.

- Get Discovered: Entrepreneurs can showcase products through Walmart’s Marketplace, RangeMe, and US Open Call.

- Mentorship: Participants are paired with seasoned retail mentors.

- Financing: Eligible businesses can apply for early payment or financial assistance.

More than two-thirds of Walmart’s product spend already supports items made, grown, or assembled in the US, and 60% of Walmart’s US suppliers are small businesses. Walmart’s efforts don’t just offer sellers opportunity—they offer insulation from the chaotic tariff landscape.

As Walmart CEO Doug McMillon explained, “Tariffs are something we’ve managed for many years… We can’t predict the future, but we can manage well.” Still, McMillon acknowledged that even reduced tariffs will result in price hikes on items that heavily rely on Chinese imports like toys and electronics.

The Crossroads of Patriotism and Price

The emerging consumer interest in American-made products presents an opportunity, but one that’s still in early stages. For sellers, the decision to lean into this trend must weigh curiosity against actual buyer intent.

Platforms like Amazon may benefit from increased transparency, such as a country-of-origin badge (akin to the Small Business or Climate Pledge Friendly badges). Meanwhile, Walmart’s investment in American-made supply chains could position it as a stable and tariff-resilient channel for small domestic suppliers aiming to scale.

Amazon’s New Seller Fulfilled Prime (SFP) Rules Shake Up the Marketplace

Amazon has announced sweeping changes to its Seller Fulfilled Prime and Premium Shipping programs—updates that will impact how sellers manage Prime-eligible orders. While Amazon says these changes are aimed at improving customer trust in the Prime badge, sellers are raising red flags about cost burdens, inconsistent logic, and tool limitations. The updated policies, which take effect June 29, 2025.

Major Seller Fulfilled Prime Changes in 2025

1. New Trial Limits and Restrictions

- Sellers will now be limited to three Amazon SFP trial attempts per calendar year.

- Trial graduation is blocked near major sales events (e.g. Prime Day, Black Friday) to prevent underprepared sellers from faltering during peak demand. For instance, the latest trial start date before the Black Friday–Christmas freeze is September 15, 2025.

2. Minimum Order Volume Requirements

- Sellers must ship at least 100 SFP packages per month (previously 90 days), and ship consistently throughout the month, or Amazon will limit their daily Prime order volume.

- Amazon clarified that this won’t revoke your SFP eligibility, but it will throttle how many Prime orders you receive until the consistency resumes. One seller wrote in Seller Forums, “You don’t ship enough, but we’re going to limit how many you can ship. ONLY Amazon would think this is okay.”

3. Enforcement and Appeals

- Amazon will disable Prime offers if performance targets are missed and give sellers a two-week window to appeal.

- There’s a new exemption rule that protects sellers from being permanently removed if they temporarily disable Prime to fix performance issues—but only if reactivation is timed correctly (preferably Sunday 00:00 PST). However, one seller encountered workflow issues that resulted in a penalty after support deactivated and reactivated his SFP midweek, leaving him no control and triggering unfair performance hits.

4. On-Time Delivery Rate (OTDR) Protection

- Sellers who use Shipping Settings Automation (SSA), Amazon Buy Shipping (ABS) or Veeqo and ship on time, will be protected from OTDR penalties on late deliveries.

- Amazon will also shield sellers from metrics impact during major carrier disruptions, such as hurricanes or infrastructure failures.

Additional Policy Updates

- Misclassified Product Penalties: Repeat offenders who incorrectly categorize product size tiers could face Prime suspension.

- Appeal Limits: Only three appeals per quarter are allowed, and only if valid. Appeals must include robust documentation (e.g. weather reports, ZIP codes, tracking IDs).

- Performance Monitoring: Sellers are encouraged to check the Seller Fulfilled Prime Performance dashboard weekly, especially before reactivating Prime.

Premium Shipping Updates

Performance Requirements

To remain eligible for Premium Shipping, sellers must now meet the following updated performance metrics:

- Valid Tracking Rate (VTR): 99%

- On-Time Delivery Rate (OTDR): 93.5% or greater (down from the previous 97%)

- Seller-Initiated Cancellation Rate: Less than 0.5%

Note: These requirements apply only to Premium Shipping orders (One-Day and Two-Day), not to SFP orders, which are evaluated separately.

Performance Monitoring and Enforcement Process

Amazon reviews Premium Shipping performance weekly, from Sunday to Saturday. If you fail to meet the standards:

- First Violation: You’ll receive an email notification.

- Second Violation: You’ll receive another warning.

- Third Violation: Your enrollment will be revoked. Premium Shipping will be disabled across all templates, and your program status will change to “Not eligible.”

If you meet all requirements for four consecutive weeks following an initial or secondary warning, your eligibility status is reset.

Reinstatement and Appeals

If your Premium Shipping enrollment is revoked:

- You must wait 28 days before reapplying.

- You can appeal by submitting a Plan of Action via Seller Central.

- To regain eligibility, you must meet all current performance requirements.

You can also voluntarily opt out by disabling One-Day and Two-Day delivery options in your shipping templates. This won’t affect your SFP offers.

Final Reminders

- There are no exceptions for peak season—you must meet performance standards year-round.

- Disabling Premium Shipping during capacity constraints is allowed by turning off One-Day and Two-Day delivery options in your shipping templates.

Sellers’ Growing Frustration and Uncertainty

The reaction from the seller community has been mixed—but largely critical. Smaller SFP sellers, in particular, are expressing concern that they’ll be pushed out entirely due to the new 100-package-per-month minimum requirement. This also explains why they feel the changes heavily favor Amazon’s Fulfilled by Amazon (FBA) model, making SFP increasingly restrictive, expensive, and ultimately unsustainable.

Other Amazon Seller Updates This Week

1. US & China Agree to Temporary Tariff Reductions Amid Trade Talks

In a move that could lower costs for many importers, the US and China have agreed to a 90-day pause on most tariffs. US tariffs on Chinese imports will drop from 145% to 30%, while China will reduce its tariffs on US imports from 125% to 10%. This truce signals a potential easing of trade tensions, but the impact will vary depending on your sourcing strategy.

To understand how these changes affect your business, try Carbon6’s Tariff Calculator.

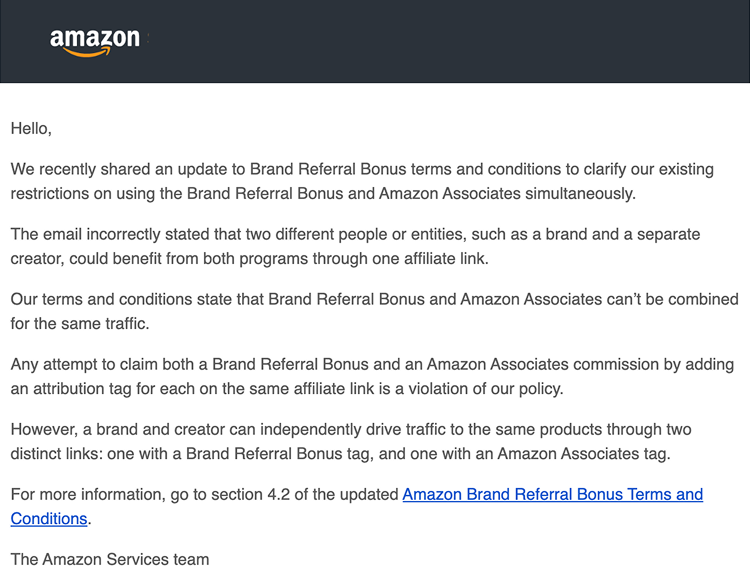

2. Clarification on Brand Referral Bonus vs. Amazon Associates Usage

Amazon issued a clarification following a misleading email regarding its Brand Referral Bonus program. The email incorrectly stated that a brand and a separate creator could benefit from both the Brand Referral Bonus and Amazon Associates on a single affiliate link. However, Amazon’s terms strictly prohibit combining both programs for the same traffic. Sellers may use both programs, but the traffic must be driven through separate, distinct links—one tagged for the Brand Referral Bonus and another for Amazon Associates. You can read more here.

Drive high-converting external traffic to your Amazon listings with PixelMe, our AI-powered external traffic solution. Boost your organic rank, maximize ROAS, and unlock Amazon’s Brand Referral Bonus program with ease. Get your free ASIN audit now.

3. New Fee Adjustments for Partnered Carrier Shipment Measurement Discrepancies

Starting June 12, 2025, Amazon will begin charging or crediting sellers based on differences between the weight and dimensions they enter for Partnered Carrier Program shipments and what carriers actually measure. Notifications will appear in the Inbound Performance dashboard when discrepancies are found.

While Amazon claims this improves accuracy, many sellers express skepticism, citing concerns that Amazon already inflates dimensional data and that it’s often impossible to know precise freight class info until after palletizing. The sentiment from sellers suggests growing frustration with what some are calling yet another unfair and unpredictable fee.

4. Amazon Reaches New Deal with FedEx for Large Residential Deliveries

After a six-year hiatus, Amazon and FedEx have signed a multiyear agreement for FedEx to handle residential delivery of select large packages. This move helps Amazon diversify delivery capacity as UPS plans to cut its Amazon volume by 50% by mid-2026. While Amazon insists it’s not replacing UPS, the partnership with FedEx could be a tactical shift to keep logistics costs down—especially as the logistics giant streamlines operations and cuts its own costs.

5. Amazon Freight and Amazon Shipping Solutions for UK Sellers

Amazon now offers two shipping solutions for UK-based sellers:

- Amazon Freight allows palletized shipments via full truckload (FTL) or less-than-truckload (LTL), whether going to Amazon fulfillment centers or other destinations.

- Amazon Shipping provides flexible parcel delivery for non-Amazon orders, including next-day and two-day shipping options.

Both services tap into Amazon’s expansive logistics network to offer competitive rates and environmental efficiencies.

6. Amazon Introduces AI-Powered Brand Name Generator

To support sellers in building strong brand identities, Amazon released a free AI-powered brand name generator. The tool suggests tailored names based on your company, product category, and target audience while also checking against the US Patent and Trademark Office for availability. Sellers can follow up with the IP Accelerator to secure legal protection for chosen names. It’s a streamlined starting point for creating a brand with long-term value.

Making the Most of What’s Changing

While recent changes across Amazon and Walmart may seem tough at first glance, they also open new doors for sellers ready to take smart, strategic action. Whether you’re reacting to tighter SFP rules or tapping into rising interest in American-made products, there are concrete ways to move forward with clarity and confidence.

- Test “Made in USA” messaging—but tie it to value: Patriotic messaging isn’t enough on its own—pair it with clear value like greater transparency or better craftsmanship. Test titles, images, and bullet points to see what drives clicks and conversions.

- Diversify with Walmart if you sell US-made goods: Walmart’s Grow With Us program provides free training, exposure, mentorship, and funding for domestic suppliers—making it a strong channel for sellers with US products.

- Audit your SFP readiness: If you’re in Seller Fulfilled Prime, review your capacity, tools, and consistency now—before the new rules hit. Aim to exceed Amazon’s minimums to stay ahead of disruptions.

- Monitor Performance Dashboards weekly: Check your SFP and Premium Shipping dashboards weekly to catch OTDR, cancellation, and VTR issues early to avoid penalties.