Top Amazon Seller News This Week

This week’s roundup brings some developments from Amazon, especially for sellers preparing for one of the biggest shopping events of the year—Prime Day.

- Prime Day 2025: Amazon’s longest Prime Day ever will span four days, with extended shopping and greater deal visibility. Deal submissions are open now, with key deadlines and staggered FBA/AWD inventory cutoffs starting May 15. New this year: Ireland joins the event, bringing Prime Day to 24 countries and boosting global sales opportunities.

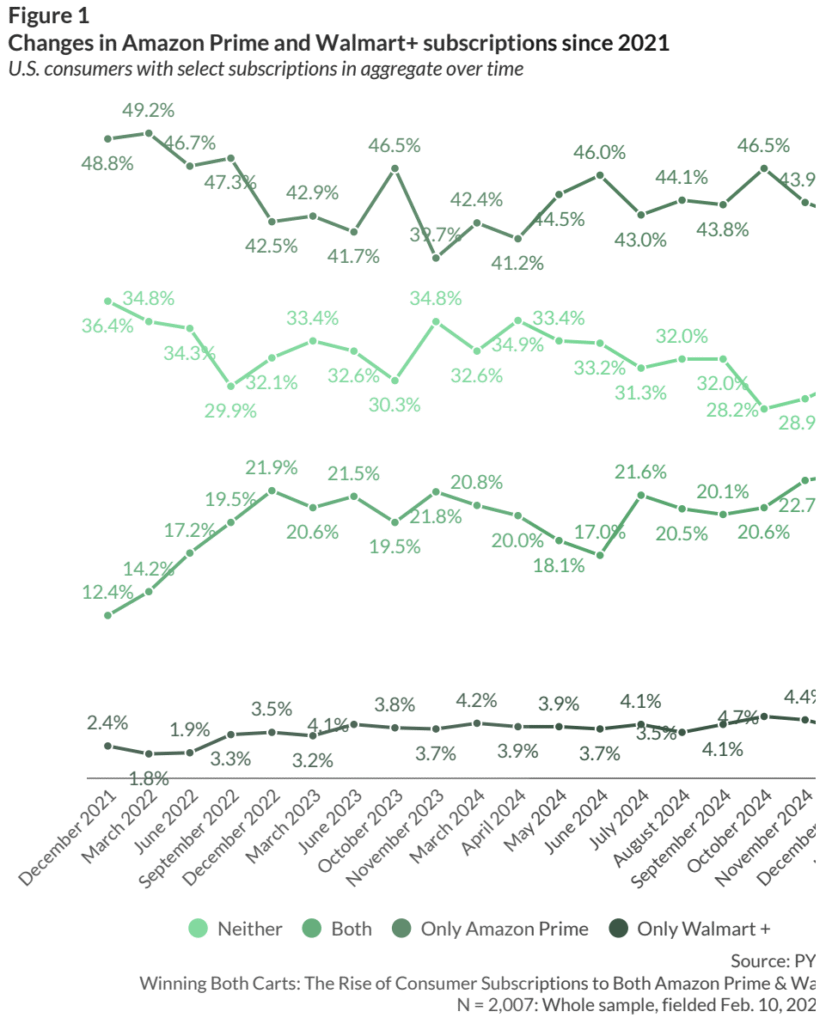

- Shoppers Go Dual – Prime & Walmart+: A new PYMNTS Intelligence report shows more consumers now subscribe to both Amazon Prime and Walmart+, nearly doubling since 2021, as they seek to maximize perks like fast shipping, exclusive deals, and cross-platform savings.

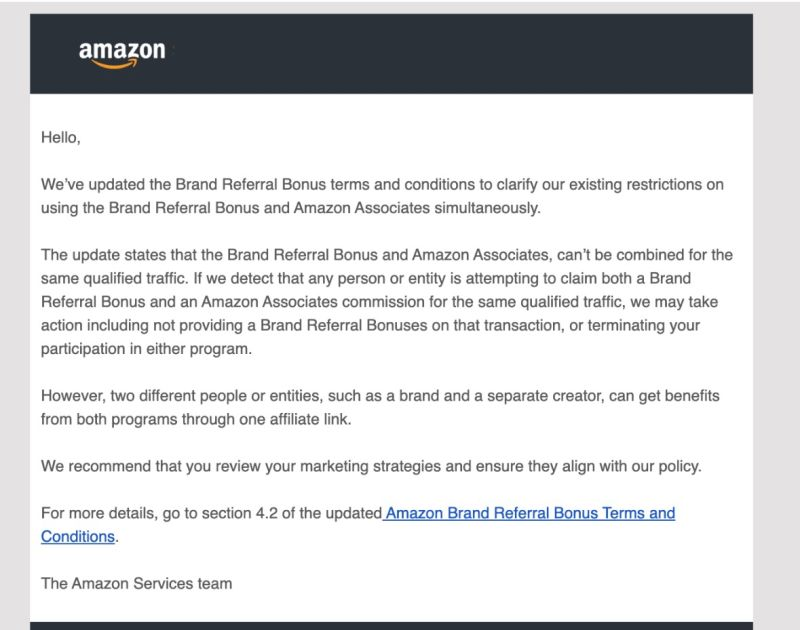

- No Double Dipping – Brand Referral Bonus Update: Amazon now bans combining Brand Referral Bonus and Associates for the same traffic. Violations risk lost bonuses or removal from the programs, so keep traffic sources clearly separated in your off-Amazon campaigns.

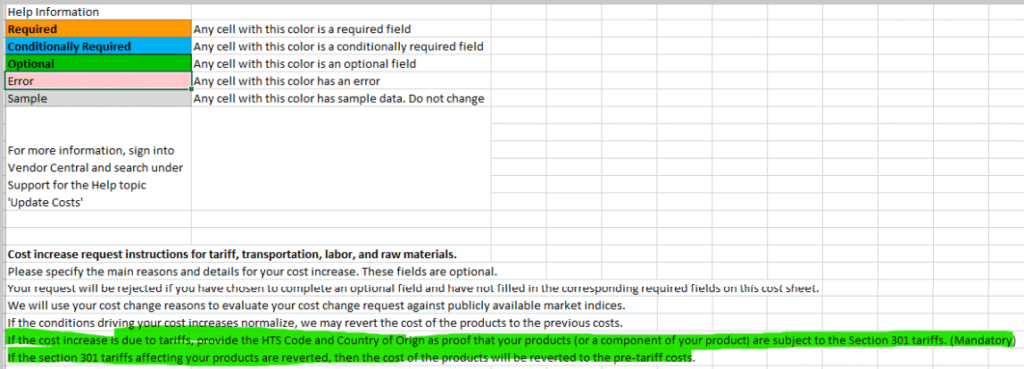

- Vendor Central Upgrades: New updates include editable external IDs, better PO confirmation uploads, and improved regional visibility. Also released: a new cost increase request form for tariff-related adjustments.

With key deadlines, new global opportunities, and changing shopper behaviors, these updates are vital for brands aiming to capitalize on a major retail moment—let’s dive in.

2025 Prime Day Prep: Tips and Timelines for Amazon Sellers

Amazon has officially announced that Prime Day 2025 will be its longest yet, expanding to a four-day event this July, providing customers with more time to shop and discover deals.

Global Expansion: Ireland Joins the Celebration

For the first time, Amazon Prime Day 2025 will include Ireland, allowing Irish Prime members to shop deals on amazon.ie. This expansion brings the total number of participating countries to 24, including the US, UK, Canada, and Japan.

Enhanced Opportunities for Sellers

Sellers can take advantage of several deal types to maximize their visibility during Prime Day.

| Deal Type | Discount Offer | Placement |

| Prime-Exclusive Best Deals | 15% or more | Shoppers will spot these Prime Day offers through special deal badges and slashed pricing that appear on product pages, search results, and in their shopping cart. They may also appear on the Amazon deals event page. |

| Prime-Exclusive Lightning Deals | 20% or more | Offers that qualify may be featured on Amazon deals page. |

| Prime-Exclusive Price Discounts | 15% or more | Exclusively for Prime members, these discounts receive an event badge visible in search, on the product detail page, and in the cart. |

| Prime Member Coupons, AKA Point-of-Sale discounts | 5% or more | Eligible coupons will be automatically promoted on the event page, shopping results, and product detail page. |

Extra Visibility for Deep Discounts

New this year—Prime-Exclusive Best Deals and Lightning Deals with discounts of 40% or more may qualify for additional placements across Amazon. This expanded exposure can connect your deals with millions of shoppers and boost visibility during peak event hours.

Promotional fee structure has changed! Know your deal fees and optimize your strategy with our Amazon Promotion Fee Calculator

Key Deadlines for Participation

- May 5, 2025: Prime-Exclusive Price Discounts submissions open.

- May 15, 2025: Deadline for Amazon Warehousing and Distribution (AWD) shipments to ensure Prime badge eligibility.

- May 23, 2025: Final day to schedule Prime-Exclusive Best Deals and Lightning Deals.

- June 9, 2025: FBA inventory deadline for Minimal Shipment Splits.

- June 18, 2025: FBA inventory deadline for Amazon-Optimized Shipment Splits.

Strategies to Maximize Prime Day Success

- Early Deal Submission: Submit your deals well before the May 23 deadline to ensure inclusion and maximize visibility.

- Leverage Enhanced Placements: Aim for discounts of 40% or more to qualify for additional deal placements, increasing your product’s exposure.

- Inventory Planning: Align your inventory shipments with the specified deadlines to maintain Prime badge eligibility and meet customer demand.

- Monitor Capacity Limits: Be aware of FBA capacity limits, which have been reduced from six to five months of expected sales volume, and plan your inventory accordingly.

- Prepare Off-Amazon Traffic Campaigns: Use Amazon Attribution to track off-Amazon marketing channels. Directing high-intent traffic to your Prime Day deals not only boosts sales but may also increase your chances of winning better placements and Buy Box visibility. Plan and launch these campaigns early to build momentum before the event kicks off.

Boost your Amazon rank with our Organic Ranking white paper. Our latest guide delivers smart, straightforward strategies for enhancing organic rankings through external traffic, listing optimization, and paid ad campaigns. Download your free ranking guide now.

Subscription Stackers: How Prime & Walmart+ Shoppers Are Reshaping Retail

The rules of retail are being rewritten—and it’s no longer just about where customers shop, but how they shop.

A new report by PYMNTS Intelligence reveals that an increasing number of consumers are subscribing to both Amazon Prime and Walmart+, using the strengths of each platform to maximize savings, convenience, and selection.

This rising “dual cart” behavior presents both an opportunity and a challenge for sellers. As consumer loyalty becomes more fluid and value-driven, understanding how to adapt your strategy across platforms is critical.

Amazon Prime vs Walmart+: Key Findings from the Report

1. Dual Retail Subscriptions Are Booming

Nearly 1 in 4 US consumers now subscribe to both Amazon Prime and Walmart+, nearly doubling since 2021. Millennials are especially engaged—37% hold both subscriptions, highlighting a generational preference for maximizing retail perks.

2. Higher Spending from Dual Subscribers

Consumers with both retail subscription services spend more. The average value of their most recent non-grocery purchase was $109.90, compared to $74.89 for Walmart+-only and $77.63 for Prime-only subscribers.

3. Strategic Shopping Habits

Dual subscribers aren’t loyal to one retailer—they’re smart shoppers who compare prices, perks, and convenience. Notably, 11% of Prime-only members shopped at Walmart for their last purchase, but none of the Walmart+-only subscribers did the reverse. Walmart is succeeding in luring Prime members for everyday shopping.

4. Payment Behavior Reflects Role

Dual subscribers tend to use credit cards for Amazon purchases and debit cards for Walmart, signaling different shopping mindsets: rewards and larger carts on Amazon, budget-conscious, real-time tracking at Walmart.

5. Grocery Belongs to Walmart

Only 1.3% of consumers made their last grocery purchase at Amazon. Walmart dominates the grocery category, reinforcing its strength as a one-stop shop.

This dual subscription trend reflects a maturing retail shopper who is selectively loyal and empowered with choice. For sellers, this demands greater agility and platform-specific strategy.

- Amazon is still king for high-value, high-convenience buys, especially when paired with its fast shipping, exclusive deals, and product discovery through events like Prime Day.

- Walmart+ is a rising force in everyday essentials and groceries, increasingly drawing traffic from Prime users who seek lower prices or local pickup.

- Both platforms are now complementary, not competitive in the eyes of modern shoppers.

As consumers “win both carts,” sellers who take a dual-platform approach—adapting to shopper behaviors, leveraging each marketplace’s strengths, and personalizing their promotions—will be positioned to win too.

New Restrictions for Amazon Brand Referral Bonus Program

In an email, Amazon announced that it has updated the Brand Referral Bonus (BRB) Terms and Conditions. The company is specifically cracking down on “double-dipping”—the practice of trying to earn both a Brand Referral Bonus and an Amazon Associates commission on the same qualified traffic.

Here’s a breakdown:

- You can’t claim both BRB and Amazon Associates commission for the same customer click. If Amazon detects this, they may:

- Deny the Brand Referral Bonus for that transaction.

- Terminate participation in one or both programs.

- In repeated or serious cases, shut down all associated selling and affiliate accounts.

- Qualified traffic must originate from off-Amazon advertisements tracked using Amazon Attribution, and must lead to either:

- A product detail page for which you’re a Brand Representative.

- A brand store page you manage as a Brand Representative.

- Bonuses are calculated on Qualified Purchases (sales of your brand’s products made within 14 days of the traffic arriving from a valid Amazon Attribution tag).

- A different brand and a separate creator (e.g., influencer or affiliate) can each benefit from one program if they’re two distinct entities—but brands cannot self-attribute affiliate links for double rewards.

For brands running omnichannel marketing strategies, this Terms update has big implications:

- No more overlap between brand-run paid ads and affiliate campaigns using the same link. If your team runs both, those traffic sources must be clearly separated and structured to avoid triggering violations. For instance, reserve BRB links for paid media and use Associates links only through third-party affiliates.

- Marketing agencies and influencers must coordinate with brands to ensure they aren’t unintentionally causing compliance issues. For example, if an influencer uses their affiliate link to promote a brand that’s also running a BRB-tagged campaign to the same audience, only one party can receive credit. Make sure influencer or affiliate partners are using their own unique affiliate links, not links intended for BRB campaigns.

Amazon’s updated Brand Referral Bonus policy reinforces its move toward greater accountability and clean attribution in off-Amazon marketing. By clearly separating your bonus-earning campaigns from affiliate-driven ones, you can maintain program eligibility, avoid penalties, and continue benefiting from performance-based rewards.

Drive high-converting external traffic to your Amazon listings with PixelMe, our AI-powered external traffic solution. Boost your organic rank, maximize ROAS, and unlock Amazon’s Brand Referral Bonus program with ease. Get your free ASIN audit now.

Amazon Vendor News: Purchase Order Changes & Tariff-Based Cost Increase Request Form

Amazon has rolled out Vendor Central updates and a new form for tariff-based cost increase requests.

Backed by internal insights from the Carbon6 team and newly released documentation, these updates aim to streamline vendor workflows and increase operational visibility. But they also require vendors to stay on their toes and update their internal processes fast.

Amazon Vendor Purchase Order (PO) Changes

- Editable External IDs: Vendors can now update external IDs directly in the PO screen, making it easier to track and align POs with internal systems.

- Custom Export Options: The old “Export to Edit” is now “Export PO Items to Excel”, allowing vendors to customize column layouts and save preferred formats.

- PO Confirmation Uploads: Vendors can now upload and view confirmation files directly, keeping the entire approval process centralized.

- Cross-Dock Region Visibility: Amazon now provides vendors with insight into the cross-dock region (e.g., West Coast, Central, Mid-Atlantic, Northeast, and Southeast) of their Ship-to location, giving them better tools for inventory planning and fulfillment.

- Priority PO Badging: High-priority purchase orders are now flagged with a badge—especially useful when regional supply is low, so vendors can take quick action on urgent inventory.

- Additional interface tweaks include stable PO history interface (unchanged since April), better row selection tools for closed PO tabs, improvements to calendar view and confirmation workflow, and retirement of the “PO Items Pending Cancellation” page (now managed under “Manage POs”).

With new changes to Amazon Vendor Central, the margin for process errors (resulting in chargebacks) just got wider. Let ChargeGuard handle the auditing so your team can focus on selling. Or, use this free interactive tool to identify and resolve your chargebacks.

Cost Increase Requests: Now Tariff-Justifiable

In a separate update spotted by Online Seller Solutions Founder, Vanessa Hung, Amazon now allows vendors to submit cost increase requests tied specifically to tariffs, particularly the Section 301 tariffs.

Here’s how it works:

- Vendors must provide the HTS Code and Country of Origin for affected products or components.

- Amazon uses this data to verify that the cost increase is tariff-related.

- If the Section 301 tariffs are ever reversed, Amazon reserves the right to revert product costs back to pre-tariff pricing.

- This submission form requires clear documentation, and Amazon will evaluate claims using public market indices and internal verification.

This is a new level of accountability and opens the door for vendors feeling squeezed by import duties to recoup some margin—but only with proper documentation.

In sum, as Amazon sharpens its approach to vendor operations with greater precision and transparency, suppliers that adapt quickly will gain an edge in preserving profitability and keeping their supply chains running efficiently.

Other Amazon Seller Updates This Week

1. Amazon’s Strong Q1 2025 Financial Performance

Amazon reported $155.7B in revenue and $17.1B in net income for Q1 2025. Despite growth in AWS and advertising, investor sentiment was mixed following comments about potential impacts from new US tariffs on Chinese imports.

2. UK FBA Fee Reductions for Clothing & Accessories

Starting May 15, 2025, Amazon UK will calculate FBA fees based only on parcel size and unit weight. The change introduces seven new parcel tiers and eliminates the returns processing fee for backpacks and handbags, with retroactive reimbursements dating back to February.

3. Amazon Debuts 7 New Delivery Station Robots

In Amazon’s ongoing push to enhance logistics, the company introduced seven new robots at its Last Mile Innovation Center in Germany. Key innovations include:

- Tipper: Automates the unloading of packages from carts, eliminating the need for manual lifting and reducing physical strain on workers.

- Echelon and Six-Sided Scanner: Work together to manage package flow on conveyor belts and capture package information from all angles, removing the need for manual scanning.

- Agility and Matrix: Determine optimal paths for package sorting, minimizing manual handling and improving ergonomic conditions for employees.

- ZancaSort: Brings packages directly to employees at an ergonomic height, reducing the need to walk through aisles or reach for parcels, thereby enhancing comfort and efficiency.

- Vision Assisted Sort Station (VASS): Utilizes computer vision and projection technology to guide employees in sorting packages accurately and swiftly, improving overall sorting accuracy.

4. New Amazon AI Tool: Enhance My Listing

Amazon launched Enhance My Listing, an AI-driven tool that optimizes product detail pages. It uses seasonal trends and listing data to recommend content improvements, helping sellers boost conversion and visibility.

5. More Carrier Flexibility in Buy Shipping

Sellers can now connect multiple accounts for each carrier (e.g., FedEx, UPS) in Amazon Buy Shipping. This allows for negotiated rate access, streamlined fulfillment across locations, and reduced risk of claims—particularly useful for Seller Fulfilled Prime and multichannel operations.

Quick Wins for Sellers Facing New Amazon Challenges

With Amazon making big moves across its seller and vendor ecosystems, brands are no longer just selling; they’re navigating a constantly evolving marketplace maze.

Here are some tips to pivot fast and play smart.

- Start Early and Stay Organized: Submit deals and inventory early to avoid missing out on Prime Day opportunities.

- Audit your current BRB strategy. Review any overlap between paid traffic and affiliate commissions, especially if you manage both in-house or through the same agency.

- Double Down on Off-Amazon Campaigns: Use Amazon Attribution to measure external traffic performance, and leverage tools like PixelMe to boost organic rank and unlock BRB rewards.

- Review and Clean Up Vendor Processes: Update your external IDs, customize PO exports, and act on priority PO badges quickly. These small operational moves can prevent major chargebacks.

- File Tariff-Based Cost Increases Proactively: If you’re feeling the squeeze from Section 301 tariffs, gather your HTS codes and supporting documents now so you’re ready to submit requests.