When you’re looking for ways to maximize 1P profit, finding places to save money is one way to go about it. Another approach is to reduce profit-draining deductions, while also recovering lost revenue when deductions do occur. The best solution? Find and invest in a strategy that achieves both, while delivering a high ROI.

In this article, we’ll take a look at ways to save money and reduce deductions, with an emphasis on justifying these winning solutions to your decision makers.

Key Insights

- A relatively low fee rate can result in significant revenue loss.

- Fee recovery is a well-mapped area, with great recovery rates possible when proper strategies are applied.

- The case for software tools and services comes down to the advantages of expertise and reduced workloads.

- In addition to higher ROI, there are indirect cost savings and strategic value to bringing on an advanced recovery solution.

Managing Deductions for Cost Savings

In the complex world of Amazon vendors and Walmart suppliers, one area that can get overlooked is deductions. Deductions include chargeback fees, shortages, and accruals. With comprehensive guidelines for ordering, delivering, tracking, and receiving inventory, many opportunities for error exist. With errors come fees and deductions.

Though small in each individual instance, deductions add up.

“You start looking into it and you realize your lunch is being eaten. We started scratching the surface and we realized … we were missing out on so much money.”

~Alex Thanasoulas, President, Global Business Development, Farouk

Even if you have dedicated teams for deduction management, there are benefits to bringing in services and software to handle this significant source of revenue drain.

Typically, an outside solution will be:

- Built to support large-scale Amazon and Walmart operations

- Automated, with a full-service approach to simplifying vendor accounting and dispute management

- Have an expert team of recovery specialists, some of whom have worked at the very companies you’re recovering from

The good news

Revenue recovery is a well-mapped area, with great recovery rates possible when proper strategies are applied. For example, 98% of cases identified by Carbon6 Revenue Recovery are confirmed by Amazon as disputable. By leveraging retailer-specific automation and a team of recovery experts, a recovery rate of 75% is possible.

The alternative?

Average vendors lose 1-5% of revenue to erroneous deductions. On $20M in sales, that’s $1M annually draining straight from your bottom line. The surprising impact often becomes clear when a free audit uncovers six to eight figures in recoverable revenue.

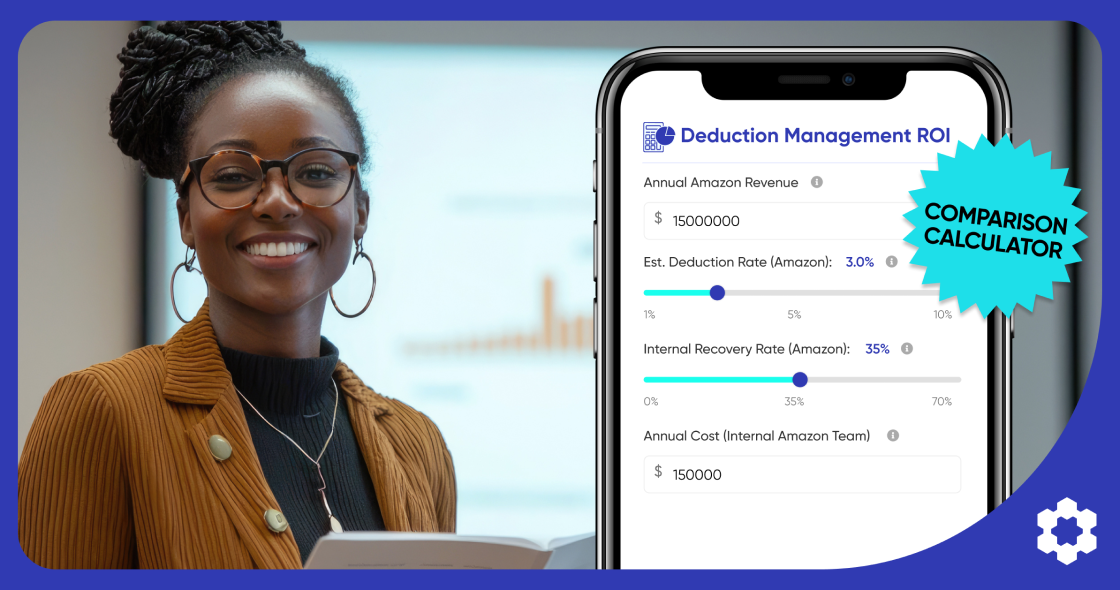

Your ROI Calculator

When presenting to your CFO, abstract formulas won’t cut it. You need numbers specific to YOUR business. That’s why we’ve built this interactive calculator – plug in your actual figures and see exactly what recovery means for your bottom line.

Deduction Management ROI Calculator

Compare your current deduction management with an external service for Amazon & Walmart.

Current Solution Amazon

Current Solution Walmart

Results Summary

Amazon Annual Impact

Walmart Annual Impact

Combined Annual Impact

Carbon6 Recovery Solution

Detailed Annual Financial Comparison

| Metric | Current Solution | With Carbon6 Solution | Improvement |

|---|---|---|---|

| Avg. Deduction Recovery Rate | 0% | 0% | +0% |

| Gross Amount Recovered | $0 | $0 | $0 |

| Cost of Recovery | $0 | $0 | $0 |

| Net Benefit from Deduction Management | $0 | $0 | $0 |

| Overall ROI (after Carbon6 Performance Fee) | – | 0% | – |

“We’re in the process of collecting money from Amazon we wouldn’t otherwise have collected, as well as improving our internal processes in regards to our Amazon 1P business.”

~Wildkin | Consumer Goods Company

Strategic Value

In addition to direct revenue recovery, implementing an expert solution yields multiple benefits that compound over time:

Operational Benefits:

- Reduced operational waste

- Improved cash flow and forecasting

- Better inventory management

- Prevention of future losses through root cause analysis

Strategic Advantages:

- Revenue protection: Ensures you recoup lost funds while maintaining healthy cash flow

- Improved relations: Efficient recovery without unneeded escalation positions your company as a reliable partner

- Data-driven insights: Identify and fix recurring issues, supply chain failings, and compliance problems

- Competitive advantage: A stellar track record for deduction management helps in retail negotiations

Making Your Case

When presenting deduction software to your CFO, focus on these main points:

- The revenue being lost. Your decision makers may not be aware of the significant losses. Consider a free audit from Carbon6 Revenue Recovery to gain clear data for presentation.

- Recovery percentages and real numbers. ChargeGuard typically recovers 75%, with figures as high as 98% in some cases.

- The intangibles. Indirect cost savings they may not be considering.

- Strategic impact. Show how this impacts the overall business objectives.

Real-World Impact

Many vendors and suppliers have found success bringing on Carbon6 to handle their deductions:

| Category | Challenge | Action | Results |

| Farouk Systems (Beauty/Haircare) | Losing profits due to Amazon knowledge deficit, errors in deduction tracking, no disputes filed on erroneous recoveries. | Audited vendor account, leveraged proprietary algorithms & expert knowledge, provided team training. | $1M recovered in 8 months. Increased recoveries from single-digit to double-digit net profit. |

| Global Publisher ($32M+ GMV) | Amazon’s initial settlement offer for historical lookback was significantly understated. | Applied industry expertise, advanced negotiation tactics, and focused on relationship management with Amazon. | Increased final settlement by 668% (from $95.8K to $736.1K). Recovered over $640K more than initially offered. |

| Global CPG Brand | High ongoing fees, need for historical shortage recovery, and desire to mitigate future fees. | Focused on historical recovery, ongoing disputing of new charges, and root cause analysis with supply chain coaching. | Over $2M in profit recovered in one year. Mitigated future fees by 30%. Pending multi-million dollar historical recovery. |

With comprehensive coverage and historical lookback, Carbon6 can find and recover pricing shortages and inventory shortages going back 5 years, chargebacks 1-2 years, and accruals looking back over the last 2 years.

When it comes to strategies to take control of your fees, shortages, and accruals, Carbon6 stands ready to deliver the ROI your company needs and deserves. See how we can help.