Imagine a world without standardized codes to classify goods and products in international trade. Shipments would be delayed, customs clearance would be a nightmare, and businesses would struggle to navigate through the complexities of global supply chains. Fortunately, we have the Harmonized System (HS) codes—a universal language that streamlines trade processes, enhances efficiency, and ensures compliance.

In today’s interconnected world, global supply chains play a pivotal role in driving economic growth and facilitating international trade. However, with the vast array of products being exchanged across borders, it becomes essential to have a standardized system for classifying goods. This is where HS codes come into the picture.

What are HS Codes in Supply Chain Operations?

A system of numerical codes known as the Harmonized System, or HS codes, is used to classify and categorize goods that are traded between countries. Customs authorities all over the world use these codes, which were created by the World Customs Organization (WCO). HS codes guarantee consistency in product classification, streamline trade processes, and give governments, businesses and regulatory bodies a common language.

The Importance of HS Codes in Global Trade

HS codes play a vital role in global trade for several reasons.

Firstly, they enable customs authorities to identify and verify goods during the import and export process. This helps in ensuring accurate customs duties, taxes, and trade statistics. Secondly, HS codes facilitate efficient data collection, analysis, and reporting for governments and international organizations. Additionally, these codes simplify documentation requirements, reducing administrative burdens on businesses and expediting customs clearance procedures.

Understanding the Structure of HS Codes

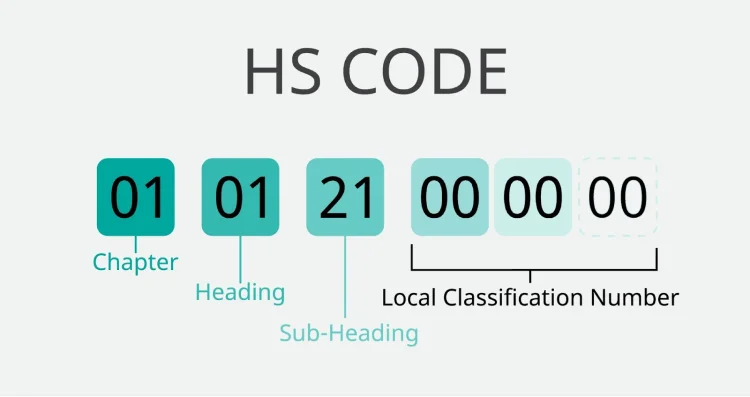

HS codes follow a hierarchical structure consisting of six digits. Each digit represents a specific level of classification, providing detailed information about the product.

Here’s how the HS code works:

The first two digits represent the chapter, which broadly categorizes goods into 99 chapters. For example, chapter 01 refers to live animals, 02 means meat and edible offal, 03 is fish and crustaceans, and so on.

The second two digits note the heading and refer more specifically to the type of product. For example, 01 stands for live horses, asses, mules and hinnies and 02 live bovine animals.

As we move further down the digits, the classification becomes more specific, allowing for a granular description of the product. For instance, the last two numbers note the product’s subheading, and “21” means pure-bred live horses used for breeding, per WCO.

Lastly, local classification number represents the additional 1 to 6 or more digits (codes will vary by country) used to notate country-specific tariff classification.

Why Should Sellers Care About HS Codes?

Mastering HS codes offers numerous benefits to businesses operating in global supply chains. By accurately classifying products, companies can optimize their logistics and inventory management processes. They can identify potential trade restrictions, tariffs, and preferential trade agreements associated with specific HS codes, enabling better strategic decision-making. Moreover, understanding HS codes enhances compliance with regulatory requirements, reducing the risk of penalties and legal issues.

But mastering HS codes is easier said than done.

Classifying an HS code can be regarded as more of an art form than a precise science, requiring years of experience to truly master. The process of assigning a HS code to a product involves following the first 4 out of 6 General Rules of Interpretation in sequential order until a classification is achieved, at which point the process concludes. Additionally, the 5th and 6th rules are applicable to all classifications.

In the consideration of Chapters, Headings, and Subheadings, traders must thoroughly examine all accompanying notes that provide definitions, exclusions, or inclusions. Moreover, the classifier must possess a comprehensive understanding of the language used in the tariff book, including the significance of commas or semicolons within descriptions.

Building expertise in tariff classification is a challenging task that necessitates focused practice and study. The rules are not inherently intuitive, and without a genuine effort to comprehend their intended application, traders will struggle to accurately self-classify various components.

If you just want to focus on the sales side of your FBA business, you may benefit from hiring a licensed customs broker who can help you find the correct HS codes for your products. Simply acknowledging the HS codes provided by your supplier or freight forwarder without verifying with customs authorities can cause issues that could be costly to your business such as:

- Excessive or insufficient payment of duties

- Confiscation of goods

- Border delays

- Delayed or denied refunds

- Steep fines and penalties

- Denial of import privileges or Free Trade Agreement benefits

- Delays can also cause additional charges like demurrage fees for failure to load/unload your inventory on time

Ensuring Compliance with HS Codes

To ensure compliance, companies should stay updated with the latest HS code revisions and changes. They must invest in training their employees on HS code classification and maintain meticulous records and documentation to substantiate their product classifications. Regular internal audits can help identify any non-compliance issues and rectify them promptly.

Suppose you’re a US importer and you accidentally misclassify your merchandise. In that case, submit a prior disclosure to the Customs Border and Protection (CBP) as soon as possible.

By voluntarily acknowledging the customs violation, providing an explanation, and paying the correct duties, you can minimize potential penalties.

It’s important to note that this proactive step must be taken before the CBP initiates its own investigation. Once their inquiry begins, the prior disclosure is no longer considered voluntary. It’s worth emphasizing that rectifying a customs violation through a prior disclosure can be a complex matter, necessitating professional guidance.

Sellers intending to file a prior disclosure should strongly consider seeking legal advice or enlisting the assistance of an expert to ensure proper preparation and submission of the necessary documentation.

Strategies for Efficient HS Code Management

Efficient HS code management requires a proactive approach. Businesses can implement the following strategies to optimize their HS code processes:

- Conduct thorough product analysis to determine the correct HS codes. In order to ensure the accuracy of your HS codes, several requirements must be fulfilled. Among these, the foremost is providing your customs broker with a precise and comprehensive description of the goods being imported or exported. It is crucial for you to provide detailed information regarding the raw materials or components of the goods, as well as their primary intended purposes. By doing so, your broker will be able to apply the appropriate classifications.

- Develop a centralized database to store HS code information and update it regularly.

- Establish clear communication channels between departments involved in HS code classification.

- Leverage technology solutions, such as automated classification software, to streamline the process. Such software utilizes artificial intelligence and machine learning algorithms to analyze product descriptions and attributes, providing accurate HS code suggestions. This not only saves time and resources but also reduces the risk of manual errors. Furthermore, advanced software solutions enable businesses to maintain an up-to-date HS code database, track changes, and generate reports for compliance purposes.

- Engage with trade associations, industry experts, and customs authorities to stay informed about changes and best practices.

Tools and Resources for HS Code Lookup

Numerous tools and resources are available to assist businesses in finding the appropriate HS codes for their products.

Online databases, such as the WCO’s HS Code Database and national customs websites, provide comprehensive search functionalities. Additionally, companies can consult with customs brokers, trade consultants, or specialized HS code service providers for expert guidance.

How to Simplify HS Code Classification

HS code classification can present challenges due to the complexity of certain products or the lack of clarity in classification guidelines.

However, businesses can overcome these challenges by investing in expert training, leveraging professional assistance when required, and regularly reviewing and updating their classification practices. Collaboration between trade partners, customs authorities, and industry stakeholders can also foster knowledge-sharing and help resolve classification-related issues.

By understanding and effectively utilizing HS codes, businesses can boost efficiency, enhance compliance, and optimize their supply chain operations.