Listen to This Article

Strategically speaking, Walmart 1P suppliers — specifically Operations and Accounts Receivable (AR) teams — may treat deductions as part of the overall cost of doing business. Most deductions are valid and therefore become part of operational procedures.

However, a “valid” deduction doesn’t mean it cannot be prevented. Deductions that are technically valid often stem from fixable root causes.

In this article, we’ll move beyond simple disputing tactics and introduce a more strategic, preventative mindset. Simply accepting valid deductions as a cost of doing business is a missed opportunity to improve long-term profitability.

Key Insights

- Valid doesn’t mean acceptable

Just because a deduction is warranted doesn’t mean you should let it keep happening. - Getting to the root cause of Walmart deductions

Discovering the cause of valid deductions offers clues as to how to prevent them in the future. - Safeguard, prevent, recover

The end game is a reduction of lost revenue through preventable mistakes, along with the recovery of deductions taken in error.

Valid vs. Invalid Deductions

Valid deductions refer to charges that are taken due to contractual agreements or compliance issues. On the other hand, invalid deductions are deductions that may have been taken in error or without proper documentation.

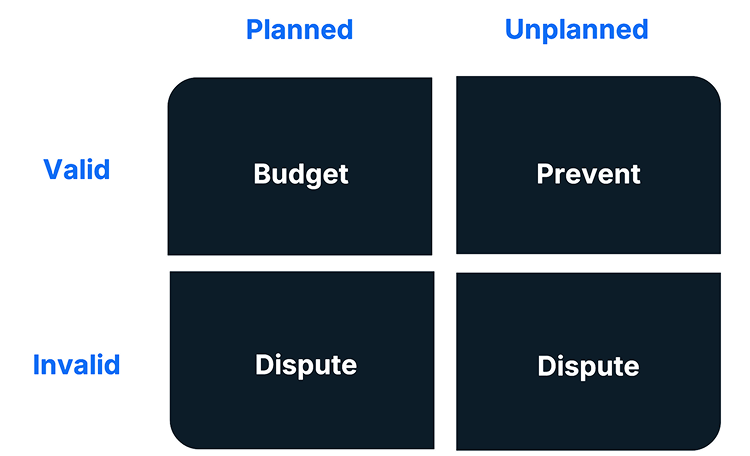

This table shows which steps suppliers should prioritize based on whether the deduction is valid or invalid, and whether it was anticipated, such as allowance deductions.

“Valid but Fixable”

Though a deduction charge may be valid according to Walmart’s requirements, deductions are often an indication of a process or an action that needs fixed. Deductions may be part of doing business with Walmart, but the goal should always be to prevent them whenever possible.

When any deduction occurs, the best action you can take is to evaluate why it happened. By treating each deduction as an opportunity to learn, your team can fix issues at the source, prevent repeat charges, and cut down on “valid” deductions that eat into your cash flow.

“Being able to dial in to the root cause of these compliance deductions and avoid them will result in not only alleviating that charge specifically, but it will also result in a reduction on those other categories as well.”

~Shelby Owens, Carbon6

Root Causes of Walmart Deductions

When trying to reduce Walmart deductions, it’s important to investigate root causes. Errors with things like packaging, labeling, logistics, and compliance with Walmart’s specific programs (e.g., SQEP and OTIF) are common operational causes of deductions.

SQEP (Supplier Quality Excellence Program) ensures that Walmart suppliers meet the retailer’s expectations for PO accuracy, labeling, packaging, and other requirements. OTIF (On-Time In-Full) is how Walmart tracks whether suppliers deliver products in the correct quantity and timeframe. Failure to meet the standards of either program is a common cause of deductions.

These errors often stem from legitimate supplier mistakes, which can be prevented with better processes, documentation, or automation.

A few examples:

| Deduction Code | Issue Type | Fix Strategy |

| Code 10 | Allowance Difference | Align invoice discounts with PO terms; document all agreements with buyers. |

| Code 11 | Pricing Overcharge (Price Difference between PO and Invoice) | Use automated price validation tools; maintain a pricing tracker with effective dates. |

| Code 22, 24, 25 | Shortages | Match ASN, PO, and invoice quantities; invoice only after confirmed shipment. |

| Code 31 | PO Number Not on Invoice | Fill out all documentation according to Walmart’s standards. |

| Code 64, 65 | Early/Late Shipment | Forecast shipments accurately; cancel unfillable POs with valid reason codes. |

| Code 94 | Goods Returned/Defective Merchandise | Increase quality control measures and product testing. |

How to Conduct a Walmart Deduction Audit

Effective Walmart deduction management should include:

- Cross-functional alignment between sales, finance, and logistics.

- Automation tools for invoice validation and deduction tracking.

- Routine audits of deduction trends to catch recurring issues.

- Proactive buyer communication to resolve setup or pricing errors before they hit the invoice.

For prevention, routine audits of trends keep you aware of where and why these deductions are happening, and help you find the hidden profit killers. Start by aggregating deduction data by type (e.g., OTIF, SQEP, pricing, returns) and department (e.g., Home & Seasonal), then do a trend analysis to identify recurring patterns by PO, item, DC, season, or buyer. From there you can do financial impact modeling to quantify cumulative losses and rank deduction types by dollar impact and frequency.

Find where your deductions are occurring, then look for ways to correct/improve your process to increase compliance and reduce fees.

Strategic Framing for Leadership

When seeking leadership’s approval for resources to combat revenue loss, speak to executive priorities such as:

- Preventing margin erosion.

- Modeling the ROI of automation tools and thorough compliance audits.

- Highlighting risk exposure by department to prioritize resource allocation.

This approach can help you gain the support you need to begin auditing your processes to prevent these issues from recurring.

PRO TIP: Learn to prevent costly deductions by fully understanding and complying with Walmart’s requirements. Our step-by-step SQEP checklist helps you ensure every shipment meets all required standards.

The Complexities of Full Oversight

Walmart’s deduction ecosystem is vast, fast-moving, and complex. Overseeing deductions internally requires a blend of operational precision, financial acumen, and constant vigilance. Internal Walmart deduction management means:

High Volume

- Thousands of deductions monthly across OTIF, SQEP, shipping, pricing, and other categories.

- Compressed timelines for dispute windows.

- Frequent policy updates that require constant retraining and operation adjustments.

Required Knowledge

- Understanding Walmart’s APDP portal and documentation standards.

- Complex audit trails which make it difficult to trace errors back to source systems or partners.

- Decoding deduction codes and root causes, often requiring cross-functional expertise (logistics, finance, compliance).

Resource Demand

- Time-consuming manual tracking and reconciliation across AP portals, remittance files, and internal systems, along with disputing Walmart deductions.

- Dispute resolution involving back-and-forth with Walmart, often requiring persistence and diplomacy.

- Teams pulled into deduction firefighting lose focus on growth-driving activities.

In short, Walmart supplier compliance and deduction management requires time, resources, and expertise.

Carbon6 exists to help you gain control of your Walmart deductions.

“So on average, as you see about 2 to 10% of a supplier’s annual revenue is lost to deductions that are actually recoverable.”

~Vanessa Cox, Strategic GTM Lead for Walmart at Carbon6

Preventing Walmart Deductions

A dedicated deductions partner isn’t just a vendor, it’s a force multiplier. Carbon6 strengthens your business with expertise and accuracy, fluency in retailer policies, and root cause analysis.

Built for suppliers, Carbon6 audits, disputes, and recovers revenue so your team doesn’t have to.

Start an audit today, and see how Carbon6 simplifies the complexities of deduction and chargeback dispute management to recover what you’re owed and prevent future profit leakage.

Engage with Expertise

As part of SPS Commerce, Carbon6 and SupplyPike help suppliers reclaim lost revenue, improve compliance and protect margins –without adding additional headcount. Our deduction management solution combines retailer-specific automation, real-time insights and expertise to help suppliers recover lost revenue from retailers like Walmart and Amazon –fast.

Explore Carbon6 Revenue Recovery.