As you make the most of Q4, ensure that you grow not only the top line sales for your business but also increase the cash in your bank account. Let’s start with your inventory, likely your largest cash outlay.

How Does Inventory Affect Cash Flow?

Cash flow is the lifeblood of your business. For a business to exist, it has to be able to take in enough cash to pay its bills. For a business to grow, cash bank accounts should also grow. A growing cash balance means you can invest in new products, new team members, and other resources that will provide a return on your investment.

If you are struggling with cash flow, meaning you don’t have enough revenue each month to cover your costs, then you must rely on savings accumulated based on past performance or seek funds from a lender or an investor.

How can sellers track cash flow?

The answer is simple: financial statements. Accountants call the Profit and Loss Statement (P&L), Balance Sheet, and the Cash Flow Statement the “holy trinity.” Let’s talk about what you should look for on each.

Profit and Loss (P&L) Statement

The P&L provides you with a look into your business performance for a snapshot in time. You can look at your revenue, Cost of Goods Sold (COGS), and Operating expenses for the month, quarter, year, or past periods. This report is great to show you trends if you compare the current month with the past months of the current year and the past year.

Balance Sheet

The Balance Sheet is the scorecard for the health of your business for its entire life. At the end of each year, the “bottom line” net profit is carried over to the balance sheet. The balance sheet also tracks your assets such as bank accounts and inventory, your liabilities, money that you owe for loans or for terms on your products, and finally your equity, where your “contributions to” and “draws from” are recorded along with the value of your business.

Cash Flow Statement

The Cash Flow Statement bridges both the P&L and the Balance Sheet and shows the impact that the business activity has on the cash accounts of the business. So if your bank balance goes down because you make a payment for inventory, this activity will be recorded. When you sell products, your cash balance goes up as you are paid for these products.

You can find the statements you need to track cash flow using accounting software such as QBO or Xero. It can also be tracked more closely, such as weekly, using software tools for this purpose or using excel. For clients that are struggling with cash flow, a 13-week cash flow model helps them overcome and avoid cash crunches.

Why is inventory negative on cash flow statements?

You will note that inventory can be either positive or negative on your cash flow statements. Cash Flow Statements cast every activity of the business based on its impact to cash. When you are accumulating inventory in your warehouse, you are spending cash and as a result inventory shows up negative. Inventory, as it is sold and you are paid, increases cash and it shows up positive

Why is inventory positive on cash flow statements?

Your inventory can have a positive influence on your cash flow, but only if it can be quickly converted to cash. Otherwise, it’s considered a drain. How often should your inventory turn to generate cash? That also depends on your industry.

How to Calculate Change in Inventory Cash Flow

Adjustments are made to inventory periodically to account for lost or damaged inventory. It is important to make these adjustments at least quarterly because they can significantly impact your profitability and your inventory forecasting.

What is inventory adjustment and why is it important?

Some sellers wait until year end to do a physical count and make an inventory adjustment and it changes their bottom line from a profit to a loss. You want to do physical counts often enough to ensure you are working with good information, but not so often that they are a drain on your resources.

When calculating changes in inventory consider the saleability of the inventory. Products that remain with the company for extended lengths of time run the risk of incurring holding costs, becoming obsolete, or declining in value. This inventory adjustment calculation does not consider how long the company owned the inventory.

By keeping cash top of mind, you can ensure that you focus on monitoring and negotiating for minimum order quantities that will tie up less cash, search for storage solutions that are less expensive, and continue to negotiate and seek out suppliers that are cost conscious.

4 Inventory Cash Flow Hacks to Increase Profitability

While accounting for inventory can be complicated, monitoring your inventory cash flow doesn’t have to be. One simple change can give you visibility into your inventory cash flow.

Hack #1: Create a Separate Checking Account for Inventory

Many Amazon sellers use one bank account for all their business activity. This creates a challenge for understanding the purpose of the money in the account.

It’s very tempting to see the balance grow and begin making plans for new equipment or staff. If the money is spent in this way, then you’re left short of cash to replenish inventory and you may have to rely on debt which will eat into your net profits.

By creating a second account just for inventory, you can move the value of the cost of goods sold (COGS) from your main checking account to your inventory checking account, as you receive the income from your Amazon settlements.

Cost of goods sold is the value of your product that you have sold. It is calculated by multiplying your number of units sold by your product cost. Product costs can include only the price you paid for the unit or you may include shipping, prepping etc. An accountant can advise what is best for you to include in COGS.

By funding a separate bank account for inventory you ensure that funds are available to make the down payment and get that next round of inventory on the way.

As a side benefit, your regular bank account will primarily be used for operating expenses that have less swings. Typically, your rent, insurance, and payroll are similar each month. With the major swings of inventory purchases hitting in a much less predictable pattern, it makes monitoring your balances for odd activity extremely difficult.

This bank account trick won’t make your accounting more complicated. You will continue to see your COGS on your Profit and Loss Statement and your Inventory value showing on your balance sheet. You can continue to monitor inventory on your cash flow statement.

Hack #2: Track Inventory on Cash Flow Statement

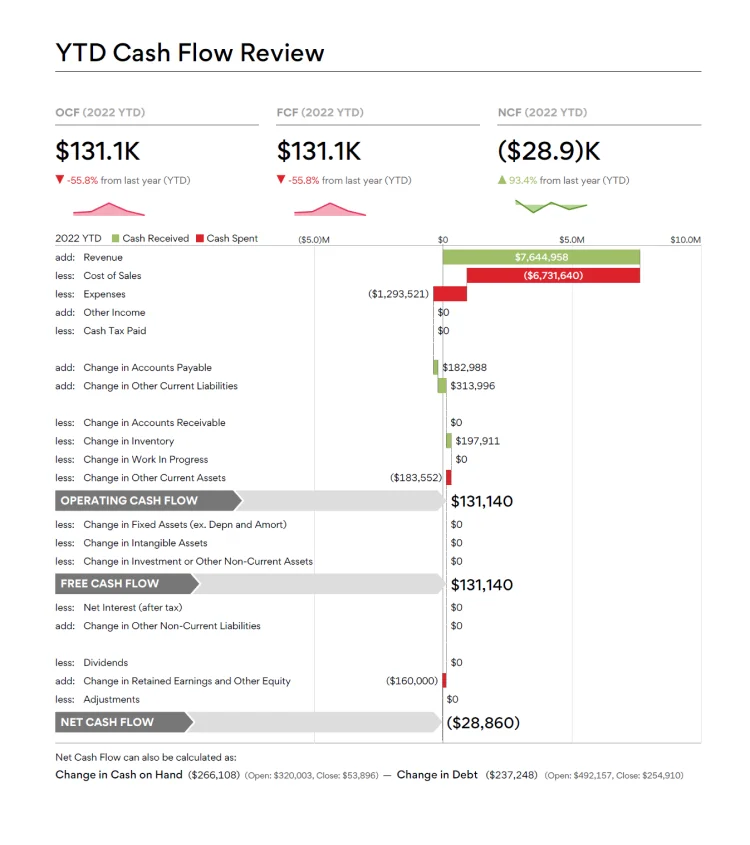

While a traditional Cash Flow Statement will show the ins and outs of your cash, these reports are often a challenge to understand for non-financial managers. We prefer a graphical report:

In the figure above, the YTD Cash Flow Review is presented in a waterfall style report which makes the cash in and out easier to follow because red reduces cash and green increases cash.

You can also see the impact of the $7.64M in Revenue as it increases cash. You can also see where a large portion of the revenue/cash was used for Cost of Sales, aka Cost of Goods Sold.

The first five lines/accounts in the report are pulled directly from the Profit and Loss Report. To get the full impact on cash, you must also look next to the six Balance Sheet accounts/lines that are impacted.

Let’s examine the Change in Inventory line.

In this example, the bar is green showing $197,911 increased cash because inventory decreased. What happened is that we removed value from the inventory account on the balance sheet over to the Cost of Sales account on the Profit and Loss Statement.

Had we purchased more inventory than our Cost of Sales, cash would have decreased, and the inventory account would have been red as it increased.

Hack #3: Analyze your Product Portfolio

In addition to understanding the reporting, it’s vital to understand how your cash flow will be impacted by your inventory portfolio and the timing of each product’s inventory purchase.

Each of your products can have varying gross margins (Cost of goods sold / by revenue x 100) and can also have different sales velocity, minimum order quantities, lead times, etc.

Ensure you are protecting your cash by avoiding high-cost items that sell slowly and require large upfront orders. Your cash will be sitting in your warehouse or going to ads. Look for those items with great margins and low costs that sell fast and that you can restock quickly. It will be a big bonus if the item sells without a huge ad spend.

Evaluate all your products this way and then compare them and develop an overall plan for your portfolio of products. You may have to cut out some products that tie up too much cash for long periods so you can prioritize products with higher margins that sell quickly. Your mission is to keep cash in your pocket.

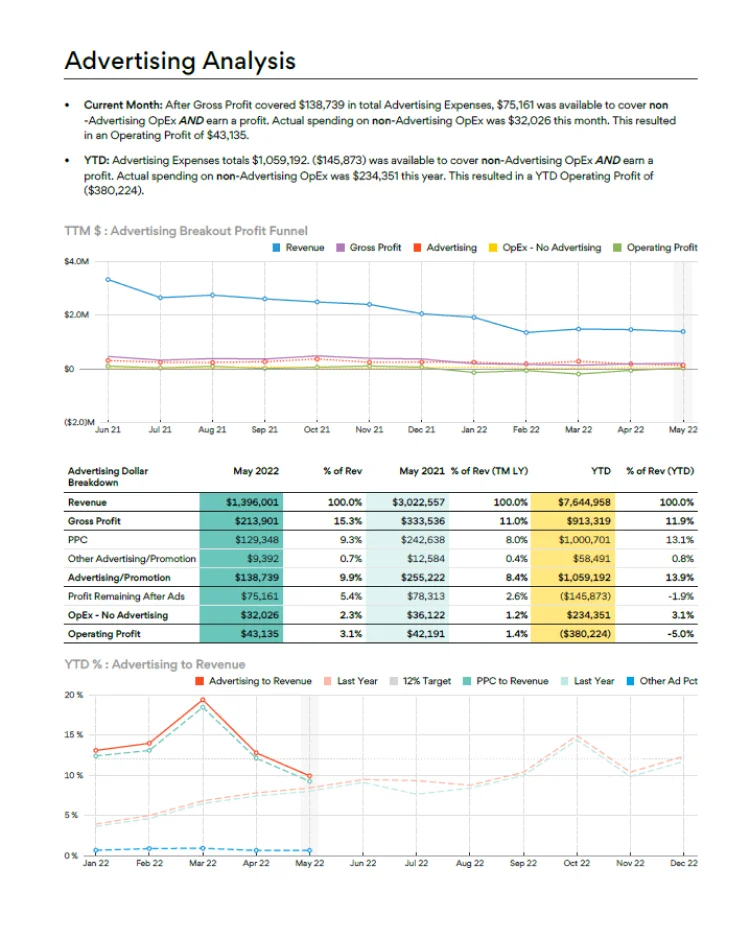

Hack #4: Examine Your Ad Spend

It’s easy to think that an analysis of your inventory is complete once you analyze your Product Portfolio as described above, but that is not the entire picture. We must go one step further and examine your advertising spend as it relates to inventory. Think about the following questions:

Am I matching my advertising to my inventory levels?

- Why spend money advertising items when you may run out of stock? As you forecast your inventory, also adjust your ad spend. What are you trying to achieve; lots of sales or profitable sales and avoiding a stock out? Set a strategy, monitor your performance, and then adjust and track it again.

Am I getting a return on my advertising dollar?

- Track your media efficiency ratio throughout the year. It’s a simple calculation of Revenue divided by advertising spend. If you calculate it every month you will start to understand the trends if you test changes in one channel or one ad process each month.

Can you experiment with your own strategy?

- It is possible to see a boost in profitability with a drop in sales. Some sellers that are struggling to improve their profitability have experimented with ads, such as cutting out all ads on a certain platform. This can cause sales to drop for the month, but increase net profit. Applying this same tactic can help you manage ads for profitability.

Looking at the database of our clients together and comparing those with a high advertising spend, it is easy to see that they are also lower in profits. Unfortunately, when comparing the revenue of those with high ad spend against those with low ad spend, there is no bump up in revenue.

Action Items

- Set up a bank account for inventory and start funding it with each Amazon settlement. Use these funds to purchase your next round of inventory. Learn more with our Profit First Quick Start Guide.

- Take time to understand your inventory on cash flow statements each month, specifically following the cash as it relates to your products.

- While portfolio analysis may be tedious, it is vital to understanding which products you should stock to optimize your cash flow. Start with your highest 20% of revenue generating products. Then do your lowest 20% of revenue generating products. Each month, take 20% of the products in the middle and within 5 months, you will have completed the analysis.

- Create a strategy for managing inventory and advertising together, and experiment and observe the impact on your cash, and adjust as needed.

Balancing Cash Outlays for Amazon Success

Inventory and advertising are two of your largest cash outlays and they have a dependent relationship on each other. Take action to understand them and manage them together with the goal of increasing cash flow, and you’ll see exponential results.