Anytime you’re selling on a large marketplace there will be guidelines and procedures to follow, with penalties usually the result of noncompliance. In each case they provide recourse for dispute resolution, where erroneous penalties can be recovered.

For Walmart that recourse is handled through their Accounts Payable Disputes Portal, or Walmart APDP.

Key Insights

A tool for Walmart suppliers

- With APDP, suppliers can submit and manage disputes directly within their Walmart portal.

- The system allows multiple claims to be filed at once.

- Claim-line disputes allow specific deductions to be challenged rather than the entire invoice.

Ways to win

- Following best practices improves success with disputes, as well as ensuring a strong retail relationship with Walmart is maintained.

- Automated solutions exist to reduce operational overhead.

If you’re a supplier working with Walmart, APDP is a game-changer for managing deductions and ensuring fair financial transactions.

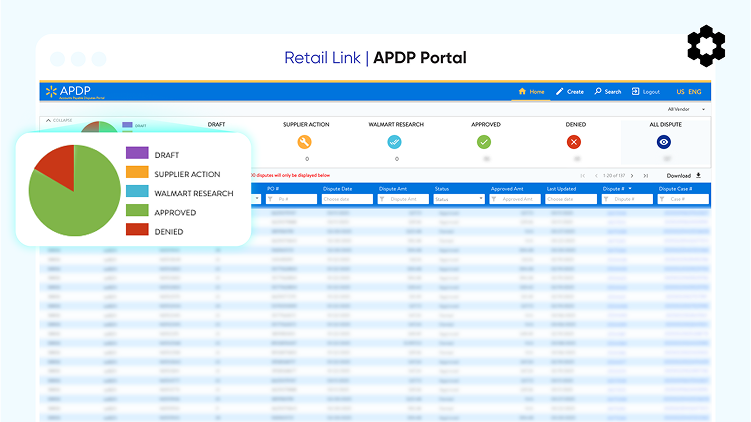

The Walmart APDP Portal

Prior to Q4 of 2021 disputes on Walmart were filed and managed through a third party. On September 27th, 2021, Walmart launched its Accounts Payable Disputes Portal (APDP), a tool designed to streamline the process of disputing accounts payable deductions for suppliers.

Using APDP suppliers can submit and manage disputes directly within Walmart’s Retail Link, which is the main portal for Walmart suppliers.

Retail Link

This is the central nervous system for Walmart’s supplier operations, enabling collaboration and communication between Walmart and its suppliers. Much like Amazon’s Vendor Central, this is where Walmart suppliers view and manage:

- Point-of-sale data

- Inventory levels

- Reports

- Business documentation

It’s also where the Accounts Payable Disputes Portal lives.

Walmart APDP: What It Does, Why It Matters

Unlike the previous third-party system, not only does the APDP allow suppliers to submit disputes for deductions, it also allows disputes at the claim-line level, rather than just at the overall deduction level. With the APDP system suppliers can:

- Monitor the status of disputes in real time

- File multiple disputes at once

Walmart introduced the portal to handle shortcomings and introduce advantages.

Increased Efficiency: With APDP suppliers no longer need to file and manage disputes externally. Everything is done within their Retail Link portal. The process becomes faster and more transparent.

Better Supplier Control: Suppliers have more direct access to dispute resolution.

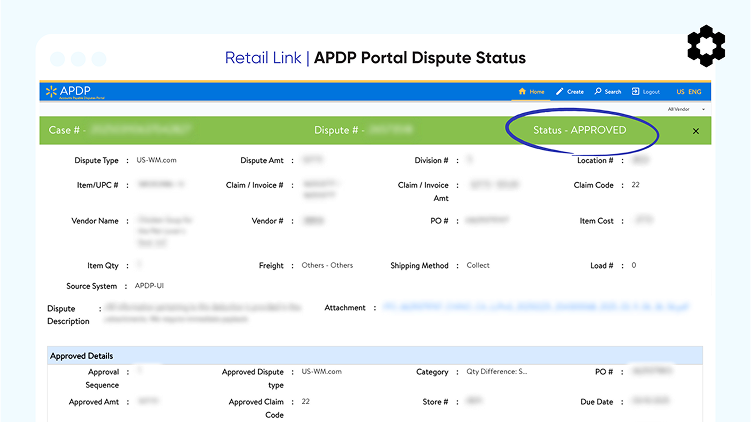

Improved Accuracy: With the introduction of claim-line disputes, suppliers can challenge specific deductions rather than entire invoices.

How It Works

To access and use the portal:

- Log into Retail Link

- Navigate to the APDP section to begin managing disputes

- View deductions tied to your invoices

- Select the deductions you want to dispute

Note: claim-line disputes allow you to challenge specific deductions rather than the entire invoice.

Managing Disputes

Once you’ve selected the deductions you want to dispute, you’ll provide supporting documentation (e.g., invoices, proof of delivery), then submit the dispute through the portal. Once submitted you can monitor the status of your disputes in real-time.

Note: For certain deduction codes multiple disputes may be filed at once, streamlining the process.

After that, Walmart reviews the claim and either approves or denies it based on the provided evidence. If approved Walmart adjusts the payment accordingly. If denied, you may need to provide additional documentation or escalate the dispute

Deduction Types

Common types of deductions Walmart suppliers can face include:

- Shortages: In this case, Walmart claims the full quantity of goods invoiced was not delivered.

- Allowances: Promotional allowances or discounts are applied to invoices.

- Invoice Related: Things like incorrectly applied tax deductions (by Walmart), incorrectly applied early payment discounts, or other remittance deductions.

- Returns: This is when a PO doesn’t flow through a returns center. Though less common, suppliers may be able to dispute them.

- Damages: When products arrive damaged and cannot be sold.

- Substitutions: Supplier delivers a different product than what was ordered, without prior approval.

- Pricing Discrepancies: When a mismatch occurs between the invoice price and the agreed-upon price on the purchase order.

- Duplicate Billing: When multiple invoices are submitted for the same order or goods.

- Compliance Fines: Such as OTIF (On Time, In Full) and Walmart SQEP (Supplier Quality Excellence Program) fines can apply to the same PO as a deduction.

Each type has specific requirements for supporting documentation, including invoices, proof of delivery and other relevant records. Being thorough — and following best practices — is the quickest route to recovery.

Best Practices

Disputing claims through the portal, while maintaining a strong retail relationship with Walmart, benefits from a few best practices.

Become familiar with the APDP platform

Make sure you understand how to submit and track disputes, and that you understand common deduction codes. Knowledge of these codes is key to successful disputes.

80% of claims fall under the following 16 codes, according to Walmart:

| Code | Description |

| 10 | Price Difference as Documented |

| 11 | Price Difference Between PO and Invoice |

| 13 | Substitution Overcharge |

| 21 | Concealed Shortage Claims |

| 22 | Merchandise Billed Not Shipped |

| 24 | Charton Shortage, Freight Bill Signed Short |

| 25 | POD No Merchandise Received for Invoice |

| 28 | Carton Damage – Frt. Bill Signed Damaged |

| 30 | Duplicate Billings |

| 51 | Promotional Allowance |

| 52 | Volume Allowance |

| 54 | Warehouse Allowance |

| 57 | Quantity Discount |

| 59 | Defective Merchandise Allowance |

| 87 | Other |

| 150 | Soft Foods Defective Allowance |

Submit line-level disputes

Learn to take advantage of disputes at the claim-line level, rather than at the overall deduction level.

Provide clear supporting documentation

This alone goes a long way toward your success with disputes. Ensure invoices, proof of delivery and compliance records are organized and attached.

Use the communication features

Be professional and communicate with dispute analysts to speed resolution and demonstrate transparency.

Be Proactive

Monitor deductions and dispute them promptly to recover your cash as quickly as possible.

Make use of automation tools

Reduce your operational overhead and streamline dispute submissions with automated solutions.

Common Mistakes and How to Avoid Them

Common mistakes suppliers make when filing disputes using Walmart’s Accounts Payable Disputes Portal stem mainly from a failure to implement the above best practices. Things like:

- Not filing at the claim-line level

- Missing documentation

- Ignoring deduction codes (each deduction has a specific code, and misunderstanding them can lead to failed disputes)

- Delays in filing

- Manual processing instead of automating

That last one (manual processing) only becomes an error when you:

- Fail to make dispute management part of your Standard Operating Procedures, and/or

- Fail to fully understand the process and execute disputes accurately and in a timely fashion.

To avoid mistakes, include dispute management in your operating procedures. Keep detailed records. Follow the above best practices. Allocate the time and resources to monitor, accurately file and track disputes.

Depending on the time and resources you have available, consider bringing on a strategic partner to manage this aspect of your operations.

Lost Time? Maybe Not

Walmart has specific timelines for submitting disputes through the Accounts Payable Dispute Portal (APDP). Exact deadlines can vary, but in general:

- The standard filing window for disputes is 24 months.

- Allowance deductions can also be disputed for up to 24 months.

- Shortage deductions must be disputed within 12 months.

Powerful technology automatically identifies and disputes up to 2 years of invalid deductions (the full filing window), focusing on key areas like carton shortages, pricing mismatches, and damaged goods.

Reduce Your Operational Overhead

Carbon6 is built to support large-scale Walmart and Amazon operations with tailored 1P revenue recovery solutions. Shifting these elements of your operational overhead to a trusted partner delivers a scalable, low-lift alternative for brands looking to recover lost revenue without additional headcount or operational overhead.

Here’s what makes us different:

- Recovery solutions for Walmart suppliers, plus Amazon vendors.

- Automated claims and transparent reporting

- Comprehensive case filing and management

- An expert team of recovery specialists

- Success-based fees