Listen to This Article

For Walmart suppliers there’s a direct relationship between product department and specific types of deductions each department is likely to face. If you’re selling on the Walmart marketplace, Walmart supplier deductions in each department — and how to avoid them — are of particular interest.

In this article, we’ll cover key departments, explain the root operational causes behind deductions, provide targeted advice for their prevention, and, importantly, give you recovery solutions when they occur.

Key Insights

- Deductions Differ: A supplier’s product department directly influences the types of deductions they face.

- Root Causes & Prevention: Understanding root causes for deductions leads to steps for prevention.

- Recovery: When deductions do occur, effective dispute management is key to recovering lost revenue.

Walmart Supplier Deductions 101

Understanding Walmart deductions and how they differ is key to effective financial management. Walmart supplier deductions fall into two main categories:

- AP (Accounts Payable) Deductions occur when Walmart processes an invoice but withholds payment for part or all due to specific issues. This can include things like return-related claims, discrepancies in allowances, and pricing errors.

- AR (Accounts Receivable) Deductions are seen as chargebacks by Walmart when it determines that a supplier owes money. These typically involve penalties such as On Time In Full (OTIF) fines, Truck Ordered Not Used (TONU) fees, and detention charges.

In each case, and across product departments, effective prevention and recovery steps can greatly reduce revenue loss.

All Deductions Are Not Created Equal

A supplier’s product department directly influences the types of deductions they face. Across departments suppliers could see deductions such as:

- Pricing discrepancies (AR)

- Shortages (AR)

- Unsalable merchandise chargebacks (AP)

- Compliance chargebacks (AP)

- Walmart SQEP fines (AP)

- Overstock returns (AP)

- Concealed shortages (AR)

Let’s take a look at how each department’s operational nature influences specific deduction categories and codes.

Deductions by Department

Suppliers can get hit harder by deductions in certain categories than in others. An overview of key product departments gives an indication of the sorts of deductions you might face, along with insight into the risks involved.

Grocery & Consumables

Often related to pricing discrepancies, shortages, damages, and compliance issues, key deduction codes suppliers may encounter:

- Code 22: Goods Billed Not Shipped (Shortage)

- Code 44: Merchandise Out-of-Date/Unsalable

- Code 69: Grocery Billback Allowance

- Code 99: OTIF (On-Time In-Full) Compliance Penalty

Apparel & Softlines

Suppliers in this category often encounter deduction codes such as:

- Code 11: Price Discrepancy Between Invoice and Purchase Order

- Code 13: Substitution Overcharge (Incorrect Item Received)

- Code 60: Apparel Allowance

- Code 94: Defective Merchandise Allowance

As well expect SQEP fines, with various codes for ticketing, hangers, polybag, or packaging violations.

Electronics & High-Value Goods

Walmart applies various supplier deductions in this category department:

- Code 10: Price Difference as Documented (Allowance Difference)

- Code 14: Short/Damaged (Trailer Seal Intact)

- Code 24: Carton Shortage/Concealed Shortage

- Code 40: Routing Violation, Excessive Freight

These deductions typically arise from pricing mismatches, incorrect shipments, damaged goods, or compliance violations.

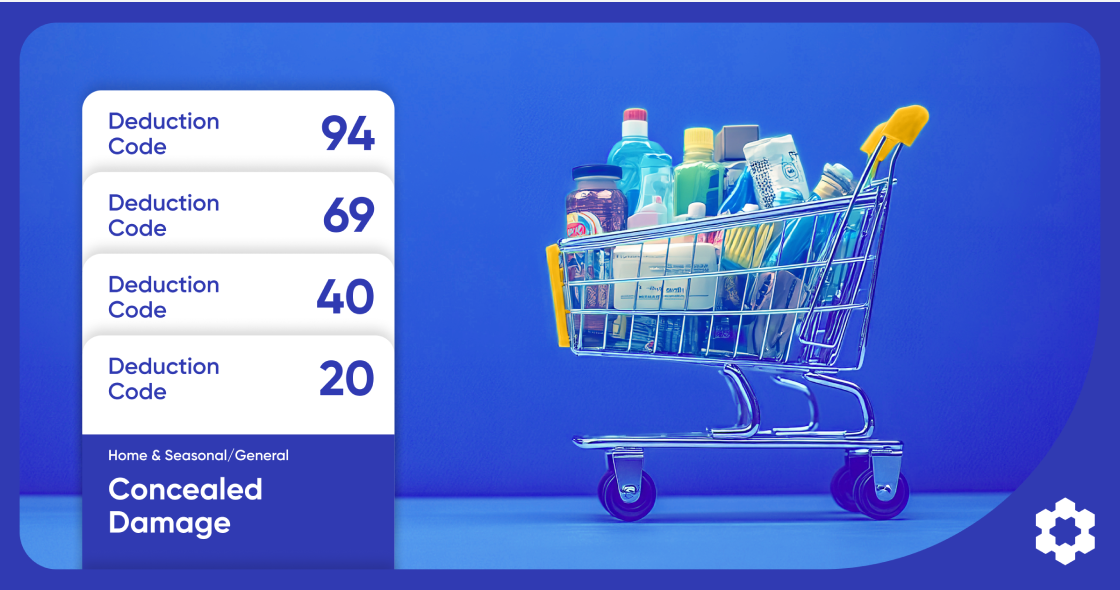

Home & Seasonal/General

Particularly relevant to Home & Seasonal suppliers:

- Code 20: Concealed Damage

- Code 50-59: Various Negotiated Allowances (markdowns, new store, etc.)

- Code 66: Markdown Monies/Price Protection

- Code 92: Merchandise Return (Overstock/Recall)

As with all categories, when these deductions occur they can be disputed through Walmart’s Accounts Payable Disputes Portal (APDP) within the specified window.

Root Causes and Their Prevention

Within each category there are root causes for deductions which, understood, lead to steps for prevention.

Preventing Walmart Deductions

To prevent deductions, be aware of the most common factors in these high-risk Walmart categories, using that insight to formulate strategies in your own supply chain and strategies to account for them.

Grocery & Consumables: This department sees fast inventory turns, typically has a short shelf life for most products, can involve complex cold-chain logistics, and has frequent promotions. These factors create a high risk for receiving miscounts, expired product, and misaligned promotional pricing.

Apparel & Softlines: Apparel introduces greater SKU complexity (size/color variations), strict floor-ready preparation standards (ticketing, folding, hangers), and due to sizing and other issues has one of the highest return rates. This makes it a primary target for compliance-related Walmart chargebacks.

Electronics & High-Value Goods: With a high value per unit and a higher risk of theft, this category demands diligent and accurate receiving counts and shipment verification. A single miscounted pallet can result in a massive deduction.

Home & Seasonal/General: These categories often involve negotiated allowances to support sales and clear seasonal inventory. Disputes arise when deductions don’t match the agreed-upon terms.

“Managing chargebacks and deductions is crucial for … Walmart suppliers aiming to maintain profitability and ensure compliance with platform policies.”

~Shelby Owens, Strategic GTM Lead for Amazon at Carbon6

Fortunately, when deductions do occur remedies exist.

Recovering Deductions When They Occur

Effective Walmart deduction management comes back to a few fundamental best practices:

- Understanding the relationship between product departments and the specific types of deductions each is likely to face.

- Implementing steps to prevent each type of deduction.

- Having a system in place to identify and dispute deductions within the allocated dispute window.

Oversight is key. Whether through your own internal systems, an external professional service that handles it for you, or some combination of both, disputing Walmart deductions should be part of your routine operations.

Walmart Deduction Management: The Expert Solution

Suppliers can lose 3-8% and even more of their revenue every year through these deductions. That’s significant. With expert deduction and chargeback management much of it can be recovered. The expert team of recovery specialists at Carbon6 Revenue Recovery help you navigate these department-specific financial risks, with oversight of this vital part of your supplier operations

Let Carbon6 identify disputes that should be addressed, file them on your behalf, and follow up with comprehensive case management to recover your revenue.

Ready to see what you’re owed? Schedule a consultation with a Carbon6 Revenue Recovery expert to get started.

Trends to Watch

2025 will continue to see shake-ups in the area of deductions, meaning suppliers need to be prepared.

Monthly Deductions: Walmart is moving to a monthly schedule, meaning less time to identify errors and file disputes.

Combined Deductions: In-store mishandling could now be deducted under the same category.

More Frequent Chargebacks: Real-time tracking and faster pattern recognition will be vital to prevent losses.

Cash Flow Risks: Invalid deductions that go undetected and undisputed lead to revenue loss.

In all this the important thing is that you have your systems in place. Monitoring, speed of filing and tracking will continue to ramp up in intensity as the year ahead progresses.