Amazon has recently announced a major shift in its Vendor Central program, with a significant number of 1P (first-party) vendors being notified that their vendor relationships will be terminated by November 9, 2024.

This decision has already caused ripples throughout the ecommerce community, as vendors scramble to adapt to the new reality of transitioning to Seller Central (3P) or finding alternative sales channels.

The implications of this shift go beyond just vendor operations—it signals a larger transformation in how Amazon is managing its platform and its relationships with sellers, vendors, and customers.

What is the Update?

The core of the update is Amazon’s decision to terminate many Vendor Central accounts, particularly focusing on US-based vendors. These vendors have been notified that after the cutoff date in November, Amazon will no longer source products from them under the 1P wholesale model.

Instead, they are being encouraged to transition to Seller Central, where they will operate as 3P sellers, managing their own fulfillment, pricing, and customer service.

Of course, that suggestion is easier in concept than in practice.

For vendors, especially those that have been working with Amazon under the 1P model for years, this shift presents numerous challenges. Transitioning from Vendor Central to Seller Central is not a simple pivot—it requires a complete overhaul of how businesses operate on the platform.

From 1P to 3P: Implications and Realities

The 1P vendor model has been a staple of Amazon’s retail operations for years, but seems undeniable now that the company sees more long-term value in its 3P marketplace, which offers Amazon better margins, less operational burden, and more flexibility in managing its business.

For 1P vendors looking to make the shift to 3P, here are some key considerations before making the leap:

1. Operational Overhaul

Most 1P vendors operate as traditional wholesalers. They sell large quantities of products to Amazon, which then handles everything from inventory management to customer service. Moving to Seller Central forces these vendors to become retailers themselves, which is a completely different business model.

At minimum, this transition would require:

- Consignment Accounting: Vendors must shift from invoice-based wholesale accounting to retail consignment, which can be a complex adjustment.

- Logistics Management: Previously, Amazon handled shipping and fulfillment for these vendors. Now, vendors must either manage fulfillment themselves or use Fulfillment by Amazon (FBA), which comes with its own set of challenges and fees.

- Learning Curve: Seller Central is a far more hands-on platform than Vendor Central, requiring vendors to manage listings, respond to customer inquiries, handle returns, and track sales performance. The learning curve is steep, and many vendors may not be fully prepared for this shift.

Speed up your sourcing and make smarter decisions with ScanUnlimited. This powerful tool swiftly analyzes wholesale product lists to uncover the most profitable, high-demand items to sell on Amazon.

2. Revenue and Cost Impacts

The financial implications for vendors are significant. While 1P vendors traditionally operated on fixed wholesale pricing, 3P sellers have more control over pricing but bear the costs of fulfillment, storage, and advertising themselves. This can lead to:

- Revenue Hits: The transition will likely result in a temporary revenue decline, as vendors adjust to the new responsibilities of managing their own inventory and pricing strategies.

- Startup Costs: Setting up as a 3P seller comes with upfront costs, including fees for using FBA, advertising on Amazon’s platform, and the resources needed to manage listings and customer service.

3. Risk of Account Suspension

Adding to the challenges, some vendors transitioning to Seller Central are at risk of account suspension during the registration and verification process. Amazon’s verification process, which includes video interviews, is notoriously backlogged, and any errors or mismatches in documentation can result in delays or suspensions, further complicating the transition.

What This Change Signals About Amazon’s Future Plans

One of the biggest criticisms of Amazon’s decision is the lack of notice and poor timing. Cutting off vendor accounts right before the critical Q4 holiday season has left many vendors scrambling to adjust.

Additionally, Amazon has provided little communication or context for the decision, leaving vendors feeling abandoned. This has fueled anxiety and uncertainty, especially for smaller vendors who rely heavily on their Amazon partnerships.

Despite those criticisms, many industry voices believe that this Vendor Central “purge” signals a larger shift in Amazon’s strategy—one that is increasingly focused on streamlining its operations, improving margins, and concentrating on higher-value relationships.

After perusing the likes of LinkedIn, YouTube, and the seller/vendor forums, two schools of thought have emerged about the reasoning behind the change:

Streamlining Operations and Focusing on High-Value Vendors

One perspective sees this move as Amazon’s attempt to simplify its operations and concentrate its resources on high-value vendors. Amazon has always had a tiered approach to vendor management, with certain key partners (such as Apple, HP, and Samsung) receiving more attention and resources than smaller vendors.

By cutting loose smaller or less strategic vendors, Amazon can:

- Optimize Resource Allocation: Vendor management is resource-intensive. By focusing on larger, more profitable relationships, Amazon can reduce operational complexity and improve its service to its biggest partners.

- Increase Efficiency: Managing fewer, higher-value vendors allows Amazon to streamline its processes and focus on driving profitability through its 3P marketplace, which offers better margins and more scalability.

Shifting Risk and Responsibility to Sellers

A less favorable interpretation of this move sees Amazon as offloading risk and responsibility onto sellers. The 3P model shifts much of the burden of fulfillment, pricing, and customer service onto sellers, allowing Amazon to collect fees while minimizing its own operational costs.

By pushing vendors into Seller Central, Amazon is effectively:

Boosting Their Own Profit Margins

3P sellers pay fees for everything from fulfillment to advertising, giving Amazon multiple revenue streams. The company no longer has to manage wholesale orders or bear the risks associated with unsold inventory.

Reducing Operational Complexity

Vendor Central requires Amazon to manage large-scale inventory and fulfillment operations, which can be costly and complex. The Seller Central model shifts much of this burden onto sellers, allowing Amazon to focus on growing its marketplace without the same level of operational overhead.

Driving More Sellers Into Using Amazon’s Logistics and Operational Tools

Amazon’s recent launch of a fully-managed, end-to-end supply chain solution, combined with its push for 1P vendors to transition to 3P selling, suggests a strategic move to encourage greater adoption of Amazon’s logistics and operational tools.

By transitioning vendors to 3P, Amazon positions itself to capitalize on several fronts, notably by offering new features that ease this shift, such as enhanced seller support, AI-driven assistance, and Buy with Prime’s expanded capabilities.

Amazon’s fully-managed supply chain solution allows sellers to offload much of the logistical burden onto Amazon, managing everything from factory pickup to delivery at Amazon’s warehouses. This is especially enticing for those forced into 3P as Amazon removes some 1P vendors, making the transition to 3P seem not all bad.

For sellers making the 1P to 3P shift, Amazon has announced at the 2024 Accelerate event a suite of tools designed to simplify the transition and enhance the overall selling experience:

- Third-Party Apps in Seller Central: Sellers now have access to key third-party apps directly within Seller Central, helping them streamline their operations without leaving the platform.

- Project Amelia: This AI-based selling expert provides assistance, recommendations, and tools, helping sellers make quick decisions. This AI integration is a notable step towards automating problem-solving and boosting seller productivity.

- Enhanced Seller Support: Amazon has introduced 100% live chat coverage for Seller Support issues, a new escalation process for unresolved problems, AI-enabled support for quick resolution of simpler issues, and a “Connect with a Specialist” pilot for complex cases. These improvements are designed to address sellers’ concerns over support quality, a long-standing pain point for 3P sellers.

- Improved Amazon Seller Mobile App: With an easier-to-navigate interface, quick access to key features, and more than 20 new functionalities planned (including integration with Project Amelia), the app aims to streamline day-to-day tasks for sellers on the go.

While the 3P model clearly shifts risk and responsibility onto sellers, these new features soften the blow. Sellers now have more control over their logistics, advertising, and customer service, while benefiting from tools that help them manage these complexities.

However, one can’t help but wonder if the true motive behind Amazon’s push for 1P vendors to shift to 3P is purely operational. The move undoubtedly boosts Amazon’s profit margins, with 3P sellers paying FBA and ad fees. By simplifying 3P operations and enhancing the seller experience, Amazon may be seeking to create a more lucrative marketplace model without the logistical complexities and costs of managing wholesale inventory.

In the end, while 1P vendors might initially feel displaced by the shift to 3P, they may stand to benefit from Amazon’s supply chain programs, enhanced seller support, and AI-powered tools—programs that could, in fact, improve their operational efficiency and increase sales. Nonetheless, Amazon’s long-term strategy seems focused on reducing its own risks while increasing reliance on its growing suite of 3P services.

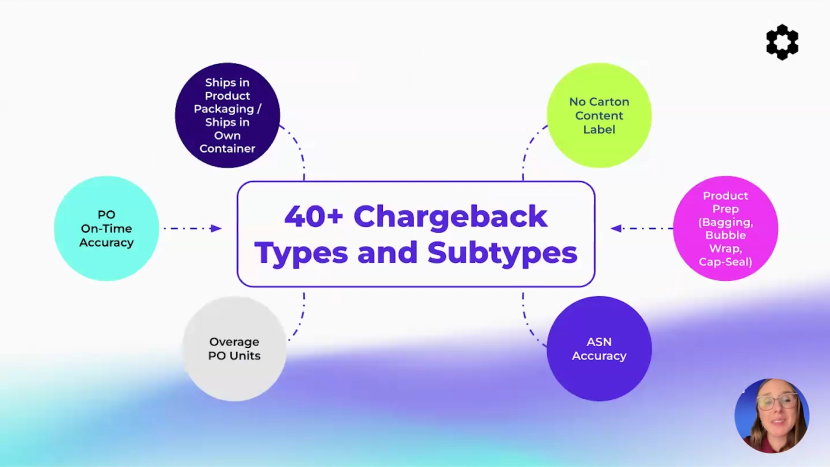

And for those vendors who will maintain their 1P relationships? They face an increasingly complex landscape of operational requirements. This overview provides insight into Amazon vendor chargebacks, Amazon shortage claims, and compliance requirements that define the 1P relationship with Amazon:

What Does This Change Mean for Amazon Sellers?

For 3P sellers already operating on Amazon’s marketplace, this shift could present both challenges and opportunities.

On the one hand, the influx of former 1P vendors into the marketplace could increase competition. Many of these vendors are established brands with loyal customer bases, and their presence in the marketplace could make it harder for smaller sellers to stand out.

Some critics argue that while this shift benefits 3P sellers in the short term, it raises concerns about Amazon’s long-term commitment to its sellers. The company’s history of sudden changes and lack of communication has led some to question whether 3P sellers will one day face the same fate as 1P vendors, forced to adapt or be replaced as Amazon’s strategy continues to change.

On the other hand, to the seller-optimist, this move also seems to reinforce Amazon’s commitment to its 3P marketplace, which could present new opportunities for sellers who are willing to adapt:

Increased Control

Vendors transitioning to Seller Central will have more control over their pricing, inventory, and branding. This could lead to healthier margins for sellers who can manage their businesses effectively.

Better Data and Analytics

Seller Central offers more detailed analytics than Vendor Central, allowing sellers to make data-driven decisions about pricing, advertising, and inventory management.

Improved Marketplace Opportunities

With Amazon shifting more of its focus to the 3P marketplace, sellers who can thrive in this environment may see new opportunities to grow their businesses.

Despite the criticism, some in the community view this move as a necessary step for Amazon to simplify its operations and focus on the 3P marketplace, which offers better margins and more scalability.

Many see this as a positive development for 3P sellers, as it reduces the number of 1P vendors and shifts more business to the marketplace model, where sellers have more control over their success.

What’s Next: Vendor Central Wrap-Up

Amazon’s Vendor Central shift is a significant development that reflects the company’s ongoing effort to streamline its operations, improve profitability, and concentrate on high-value relationships.

For vendors, this shift presents a number of challenges, from operational overhauls to financial impacts and the risk of account suspension. For 3P sellers, the move opens up new opportunities but also raises concerns about increased competition and Amazon’s long-term strategy.

As always with Amazon, the key to success will be adaptability, as sellers and vendors alike must continue to evolve in response to the company’s ever-changing strategies.

Stay agile, and keep moving forward!