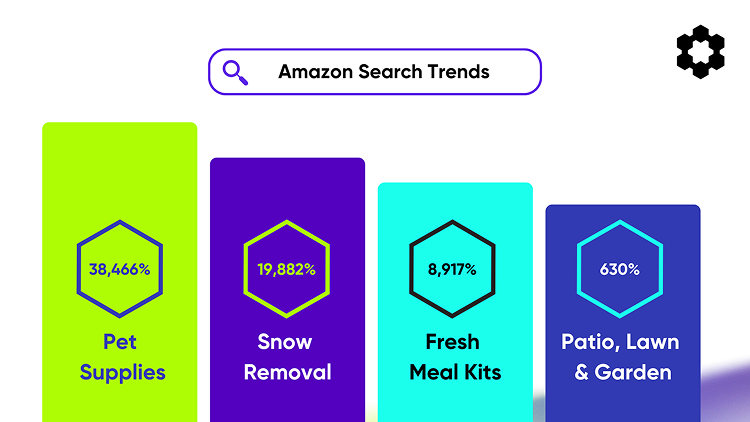

Understanding customer search behavior is the compass that guides successful selling strategies. Amazon’s newly released consumer search trends report provided a data-rich roadmap of what shoppers wanted this year and where the market is headed next.

In this post, we’ll jump into the most important takeaways, including the numbers that matter and opportunities hiding in plain sight.

Amazon Search Trends You Can’t Ignore

Before we explore the details, here are the most impactful developments Amazon sellers should be acting on immediately:

- Pet Supplies Explosion (38,466% growth): Novelty pet products like “cat batman mask” drove unprecedented demand, signaling a viral trend with massive potential.

- Weather-Driven Opportunities (19,882% growth in Snow Removal): Snow blowers saw a 116,241% search volume increase, highlighting how seasonal needs can create instant markets.

- Meal Kit Craze (8,917% growth): Convenience is king as fresh meal kit searches soared, particularly around holidays.

- Outdoor Living Boom (630% growth in Patio, Lawn & Garden): The highest category growth overall indicates sustained consumer investment in home spaces.

- Electronics & Health Product Launch Success: These categories saw the highest percentage of successful new products (31% and 28% respectively), making them prime targets for innovation.

Search Volume Patterns: Following the Money

Amazon’s consumer search data reveals distinct seasonal patterns in 2024, with volumes starting strong in January (14.23B searches), dipping mid-year to a low of 10.63B in June, before climbing dramatically to end the year with 20.93B searches in December.

This Q4 surge presents a clear directive for sellers: inventory planning should account for search volume nearly doubling from September to December. But the data also reveals opportunity in traditionally “slower” months where competition may be less fierce.

Take control of your seasonal inventory planning with SoStocked. Our forecasting prevents stockouts and costly storage fees by predicting demand, automating reorder points, and preventing fees. See your recommended actions before it’s too late.

Category Performance: Where Growth Lives

The report highlights dramatic disparities in category growth rates:

Top Growth Categories (YoY)

- Patio, Lawn & Garden: 630%

- Handmade Products: 427%

- Toys & Games: 412%

- Clothing, Shoes & Jewelry: 363%

- Electronics: 266%

Consumers are investing heavily in their homes, creative pursuits, entertainment, and personal style. For sellers, the key insight is that these growth areas represent markets where customer acquisition costs might be offset by expanding demand.

What’s equally revealing is the search volume distribution:

- Home & Kitchen leads with 18% of total search volume

- Clothing takes 17%

- Health & Household captures 9%

These established categories command attention but come with fierce competition. The strategic seller might look instead at high-growth categories with more modest overall volume as entry points.

Subcategory Gold Mines

Diving deeper reveals explosive growth in specific subcategories:

Hardlines Standouts

- Snow Removal: 19,882% growth

- Pest Control: 2,881% growth

- Material Handling Products: 2,880% growth

Softlines Risers

- Pet Supplies: 38,466% growth

- Novelty & More: 740% growth

- Fabric Decorating: 526% growth

Consumables Leaders

- Fresh Meal Kits: 8,917% growth

- Food & Beverage Gifts: 1,551% growth

- Gifts: 624% growth

The granularity in this data uncovers specific product types driving these Amazon search trends. For example, “Snow Blowers” saw 116,241% search growth, while “natural egg dye kit” experienced 46,574% growth.

For sellers using Carbon6’s Advertising solutions, these insights could transform keyword targeting strategies, directing ad spend toward these rapidly emerging search terms before competition intensifies.

Discover untapped revenue with PixelMe’s AI-powered Keyword Harvester, the smart way to identify high-converting search terms driving real Amazon sales. Automatically collect and prioritize winning keywords to refine ad targeting, expand your reach, and boost conversion rates. Get your free ASIN audit now.

Breaking Down Search Behavior by Item Type

The report dissects search patterns into three main categories—Hardlines, Softlines, and Consumables—revealing how specific item types drive subcategory performance.

In Hardlines, Snow Removal dominates with “Snow Blowers” (116,241% growth) leading the charge, followed by “De-Icers & Salt Spreaders” (711%).

For Softlines, Pet Supplies stands out with “cat batman mask” (38,466% growth) creating an unexpected surge, while Fabric Decorating items like “natural egg dye kit” (46,574%) demonstrate how craft-related searches are gaining momentum.

In Consumables, seasonal items drove remarkable growth, with “gluten free easter candy” (185,933%) and “boo basket for kids” (39,518%) highlighting how shoppers are increasingly searching for specialty food gifts online.

These Amazon search trends underscore a crucial insight: while some growth is cyclical or seasonal, the dramatic rises in complementary accessories and niche products suggest untapped potential for sellers who can rapidly develop inventory in these areas.

Market Concentration: Finding White Space

Perhaps the most actionable section of the report examines market concentration through click-share analysis. This reveals subcategories with high growth potential but low market concentration—the sweet spot for new entrants.

Home Decor Accents emerges as a standout opportunity with 762% search growth in 2024. With no dominant seller capturing most traffic (the top 20 products account for just 62% of clicks), this fragmented market suggests room for new products and brands.

Sellers should prioritize subcategories showing strong conversion rates and low click share concentration for new product development. These areas offer the rare combination of growing demand with limited competitive dominance.

New Product Success Stories

The report concludes with data on successful product launches across categories. Electronics (31%) and Health & Household (28%) lead with the highest percentage of successful new product launches, defined as those achieving annualized revenue exceeding $50,000 within 30 days.

For sellers contemplating expansion, these numbers provide direction on which categories offer the most hospitable environment for new entrants. The success rates suggest consumers in these spaces are more receptive to trying new products—a crucial factor when calculating the risk of inventory investment.

Applying These Insights to Your Amazon Business

The wealth of data in Amazon’s Consumer Search Trends Report offers multiple pathways to growth:

- Audit Your Current Categories: Compare your inventory against growth trends to identify gaps and opportunities.

- Optimize for Seasonal Surges: Plan inventory and PPC campaigns to align with the dramatic Q4 increase in search volume.

- Explore Growing Niches: Consider expansion into high-growth subcategories, particularly those with fragmented competition.

- Refine Keyword Strategy: Update listings to capture emerging search terms related to your products.

- Develop Complementary Products: The data shows accessories and related items experiencing dramatic growth alongside primary products.

Expand your reach beyond PPC with DSP Prime. Our expert-managed advertising solution leverages Amazon’s first-party data to connect your brand with high-intent audiences across websites, apps, and streaming platforms. Get your customized growth plan now and launch in just 10 days.

Final Thoughts

The 2024 Amazon Search Trends Report reveals a marketplace in constant evolution, with dramatic shifts in consumer interest creating both challenges and opportunities for sellers.

What remains consistent is the advantage held by data-driven sellers who can identify and act on these trends before they become apparent to the broader market. By combining Amazon’s search insights with Carbon6’s suite of seller tools for inventory management and advertising optimization, sellers can position themselves to capitalize on these emerging opportunities.

For those looking to dig deeper, the complete report contains additional insights on specific search terms and market concentration metrics that could inform product development and marketing strategies.Download the full Consumer Search Trends Report for comprehensive data to power your 2025 selling strategy.

Get ahead of trends with our weekly Amazon Seller Newsletter. With over 210 issues published, it’s your go-to resource for critical updates on policy changes, announcements, and community events. Subscribe or share with your team to get seller news delivered weekly.